(Bloomberg) — European stocks struggled for traction and U.S. futures fell as traders braced for a slew of economic data later in the week that will help determine the direction of monetary policy.

Most Read Articles on Bloomberg

The Stoxx Europe 600 index was little changed, with gains in insurance companies and utilities offsetting losses in the technology sector. Among individual stocks, ASM International NV fell after the chip equipment maker's disappointing earnings forecast. Housewares maker Reckitt Benckiser Group's shares fell as much as 10% as sales fell. St James's Place posted a pre-tax loss and fell more than 20%.

Traders are refraining from making big bets ahead of U.S. gross domestic product, inflation, a parade of central bank speeches and eurozone price data. Investors are grappling with lower expectations about how much the US Federal Reserve (Fed) and European Central Bank (ECB) will cut interest rates.

“Concerns remain that visibly resilient economic activity could lead to higher inflation or a slower decline in inflation,” said Senior Market Analyst at Capital.com. , Kyle Rodda said, “U.S. growth is on track very well, especially given the stage in the rate hike cycle,” which is probably why expected rate cuts were withdrawn so quickly. Ta.

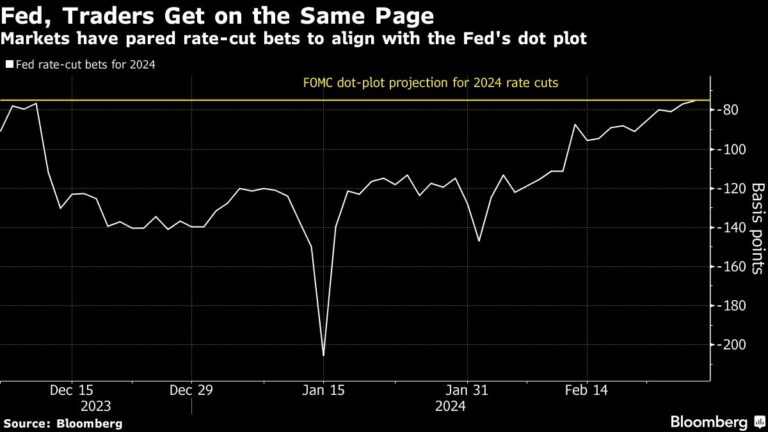

Markets are moving to price in only 75 basis points of US easing through the end of the year, consistent with the most likely outcome given by Fed policymakers in December. US bond yields fell and the dollar strengthened.

Elsewhere, the New Zealand dollar weakened by 1%, along with government bond yields, after the Reserve Bank of New Zealand issued less hawkish comments on inflation, citing declines in most measures of price expectations. % fell. The central bank kept interest rates unchanged, as expected by economists.

Hong Kong's stock benchmark fell more than 1% after the budget report did not impress investors. Chinese stocks fell after recent gains hit resistance levels, with traders looking for momentum from this week's manufacturing report and a key political conference in Beijing next week. Japanese stock prices fell slightly, but South Korean stock prices rose 1%.

Crude oil fell after a second day of gains on signs of rising U.S. inventories and hopes that OPEC+ will extend supply cuts. Iron ore fell again as investors remained undecided on the strength of China's steel demand ahead of China's usual peak construction season.

This week's main events:

-

Eurozone economic confidence, consumer confidence, Wednesday

-

US wholesale inventories, GDP, Wednesday

-

Fed's Rafael Bostic, Susan Collins and John Williams speak on Wednesday

-

G20 finance ministers and central bank chiefs will meet in Sao Paulo from Wednesday to Thursday

-

German CPI, unemployment rate, Thursday

-

US Consumer Income, PCE Deflator, New Unemployment Insurance Claims, Thursday

-

Fed's Austan Goolsby, Raphael Bostic and Loretta Mester speak Thursday

-

China official PMI, Caixin manufacturing PMI, Friday

-

Eurozone S&P World Manufacturing PMI, CPI, Unemployment Rate, Friday

-

BOE Chief Economist Hugh Pill speaks on Friday

-

US Construction Spending, ISM Manufacturing, University of Michigan Consumer Sentiment, Friday

-

Fed's Rafael Bostic and Mary Daly speak on Friday

The main movements in the market are:

stock

-

As of 8:22 a.m. London time, the Stoxx European 600 was down 0.1%.

-

S&P 500 futures fell 0.2%

-

Nasdaq 100 futures fell 0.3%

-

Dow Jones Industrial Average futures fell 0.2%.

-

MSCI Asia Pacific Index falls 0.6%

-

MSCI Emerging Markets Index falls 0.7%

currency

-

Bloomberg Dollar Spot Index rose 0.2%

-

The euro fell 0.3% to $1.0816.

-

The Japanese yen fell 0.2% to 150.76 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.2170 yuan to the dollar.

-

The British pound fell 0.3% to $1.2644.

cryptocurrency

-

Bitcoin rose 3.3% to $58,589.51.

-

Ether rose 1.6% to $3,301.86

bond

-

The 10-year Treasury yield fell 1 basis point to 4.29%.

-

Germany's 10-year bond yield fell 1 basis point to 2.45%.

-

The UK 10-year bond yield fell 1 basis point to 4.18%.

merchandise

This article was produced in partnership with Bloomberg Automation.

–With assistance from Rob Verdonck.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP