-

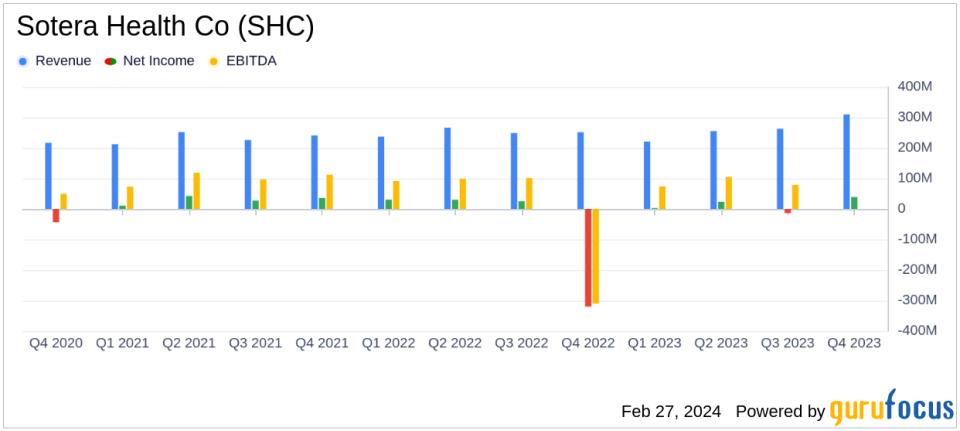

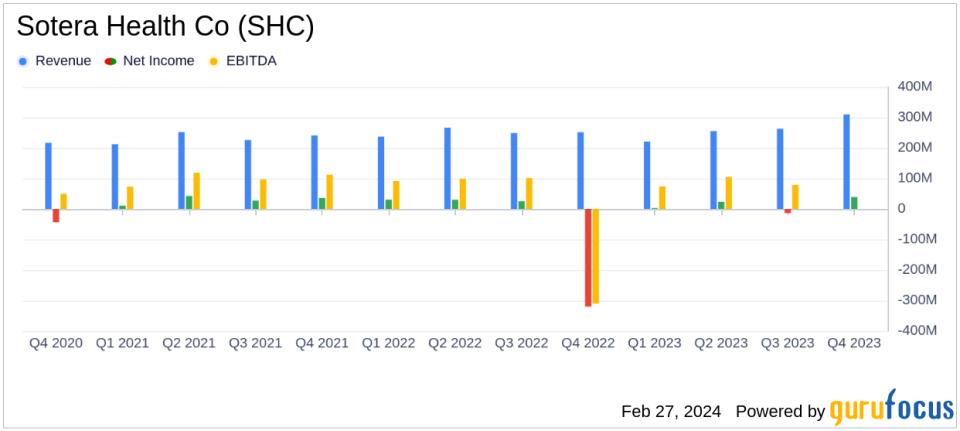

net revenue: 4.5% increase to $1.05 billion in 2023.

-

Net income: Reported $51 million or $0.18 per diluted share in 2023.

-

Adjusted EBITDA: Increased by 4.3% to $528 million in 2023.

-

Adjusted EPS:Decrease of $0.15 per diluted share to $0.81 in 2023.

-

Outlook for 2024: Net revenue and adjusted EBITDA are expected to grow between 4.0% and 6.0%.

On February 27, 2024, Sotera Health Co (NASDAQ:SHC) released its 8-K filing, announcing fourth quarter and full year 2023 financial results and 2024 outlook. Mission-critical sterilization solutions, clinical testing, and advisory services for the healthcare industry are operated through his three segments: Sterigenics, Nordion, and Nelson Labs. These divisions serve the United States, Canada, Europe, and other regions, and offer a wide range of services from terminal sterilization to analytical chemistry testing.

Performance and challenges

Sotera Health's 2023 performance reflects a company that has strategically weathered economic headwinds. Net revenue increased 4.5% to $1.05 billion, a testament to the company's resilience and the essential nature of its services. However, the decline in adjusted EPS from $0.96 to $0.81 highlights the challenges it faces, including macroeconomic pressures and the impact of inflation.

Chairman and CEO Michael B. Petras Jr. commented on the company's adaptability and commitment to core values as critical to achieving growth. He noted the completion of his four capacity expansions by Sterigenics, the successful navigation of his Cobalt-60 supply chain by Nordion, and the continued delivery of world-class service by Nelson Labs.

Financial results and materiality

The company's financial results, particularly its net revenue and adjusted EBITDA growth, are significant in the medical diagnostics and research industry, where continued investment in technology and capacity expansion is critical. These financial metrics demonstrate Sotera Health's ability to invest in future growth and innovation, which is essential to remaining competitive.

Key financial indicators

Key financial details in the income statement, balance sheet, and cash flow statement include:

“Net revenue for the fourth quarter of 2023 increased 23.3% to $310 million, compared to $252 million in the prior year period. Net income was $39 million, or diluted 1 $0.14 per share, compared with a net loss of $320 million; $1.14 per diluted share in the fourth quarter of 2022, including statutory reserves of $408 million. I will.”

As of December 31, 2023, Sotera Health had total debt of $2.3 billion and cash and cash equivalents of $296 million. The net leverage ratio was 3.8x, up from 3.2x at the end of 2022. The company's liquidity position provides financial flexibility with no revolving credit facilities outstanding and significant debt outstanding maturing until 2026.

Analysis of company performance

Sotera Health's 2023 results demonstrate that the company is effectively managing its resources and exploiting market opportunities. Net revenue and adjusted EBITDA growth, combined with a strong balance sheet, positions us well for future investments and potential market expansion. The company's positive outlook for 2024, with expected growth in both net revenue and adjusted EBITDA, suggests confidence in the company's strategic direction and market demand for its services.

For more information and updates on Sotera Health's financial performance and strategic initiatives, investors and interested parties are encouraged to visit the Investor Information section of the company's website.

For more insights and analysis on Sotera Health Co and other companies of interest to value investors, visit GuruFocus.com.

For more information, please see the full 8-K earnings release from Sotera Health Co here.

This article first appeared on GuruFocus.