good morning. I think it's safe to say that we've all heard quotes and anecdotes about the benefits of always being prepared for opportunity. I found that philosophy to be true. I think Citizen Financial Group provides a concrete example of this.

Citizens, headquartered in Providence, Rhode Island, was the 14th largest bank in the United States with $222 billion in assets as of Dec. 31. I recently spoke with John F. Woods, Citizens' vice chairman and chief financial officer, about the latest developments.edition of luck's “Future of Finance'' series.

“For many years, one of our strategic goals has been to be able to serve high-net-worth individuals,” he told me. “We did that a while ago when we acquired a company called Clarfeld, which created the ability to advise a high-net-worth customer segment. We weren't able to expand that platform because we needed enough bankers to do it. An opportunity presented itself last spring when the First Republic started to fall into trouble.”

First Republic Bank was closed by the California Department of Financial Protection and Innovation on May 1, 2023, and the FDIC was appointed receiver.

“We had the opportunity to make a bid to acquire First Republic,” Woods explained. “We didn't win that bid, JPMorgan did. But as part of that process, we became very attracted to First Republic's business model. And a lot of the private bankers who worked at First Republic didn't want to work for a very big bank — that's why they worked there in the first place.”

Conversations with a small group of people accelerated and expanded to about 150 people hired as private bankers working in California, Boston, New York and Florida, Woods said. Earlier this month, the bank announced the hiring of Michael Cherney as head of asset management advisors and Tom Metzger as head of private wealth managers. Citizens opened its first private banking office in Boston, with plans to open additional offices in Palm Beach, Florida in 2024 and Mill Valley, California in the spring.

Woods expects the private bank to generate significant profits. “We have just officially launched [the private bank] “We already have over $1 billion in deposits in the fourth quarter of 2023,” he told me.

During the conversation, Woods also discussed how the role of the CFO is changing. “The evolution of his CFO role over the past decade has increased the expectation that he is a partner to CEOs and business unit leaders in guiding CFO strategy.”

You can read the full Future of Finance interview here.

Cheryl Estrada

sheryl.estrada@fortune.com

Leader board

Cosmin Pitigoy Named CFO of Flywire Corp. (Nasdaq: FLYW)effective March 4. Mr. Pitigoy previously spent 20 years in finance leadership roles at PayPal and eBay, most recently as SVP of PayPal Finance. During her time at eBay, Pitigoy held leadership roles in Investor Relations, the FP&A business unit, and the finance department, beginning her career in operational and finance roles at E-Trade and Barclays.

michael niggeman will serve as interim CFO. He was appointed on May 7, in addition to his previous role as director of the Lufthansa Group's Human Resources, Logistics and Non-Hub Business Units. Current chief financial officer Remko Steenburgen is one of four executives to resign as the airline undergoes a “management restructuring and reorganization,” according to a statement. It is. Lufthansa said the decision came as the company is emerging from the coronavirus era.

big deal

Employers often rely on universities as key suppliers of professional talent, but universities do not guarantee success in the labor market, according to a new report by the Burning Glass Institute and the Strada Education Foundation. .

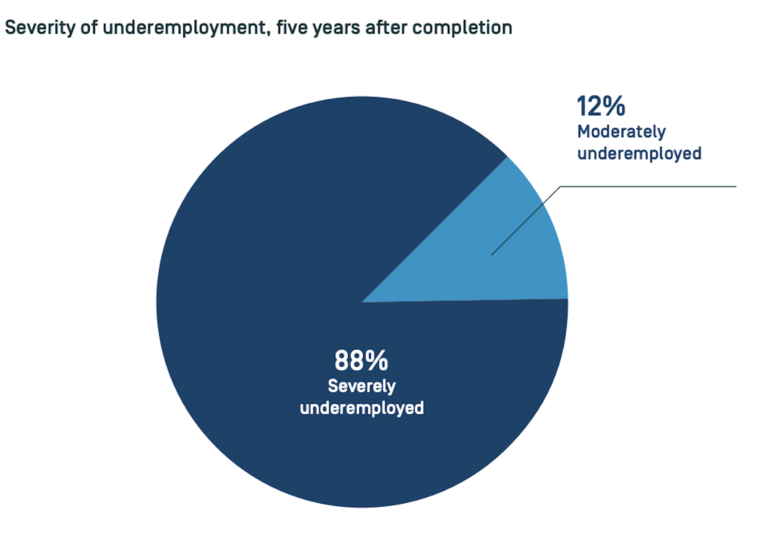

“Talent Destruction: College Graduation, Underemployment, and the Way Forward” finds that one of the biggest risks students face is not being able to get a college-level job despite earning a degree. I understand. Currently, only about half of students with a bachelor's degree find a university-level job within a year of graduation, a study found. The majority of new graduates (88%) are severely underemployed, working in office support, retail sales, food service, and other jobs that typically require only a high school education or less. I have a job where I do. Blue-collar roles in construction, transportation, and manufacturing.

Only 12% of people are moderately unemployed, for example, those in jobs that require more education or training than a high school diploma but less than a bachelor's degree. The findings are based on a dataset of 60 million workers in the United States, including about 10 million with a terminal bachelor's degree.

But getting an internship can make a difference. The report found a strong correlation between internships and college-level employment after graduation. On average, graduates with at least one internship are 48.5% less likely to be underemployed than graduates with no internships. The benefits associated with completing an internship are relatively strong in any degree field.

even deeper

The world's largest companies are providing more detailed information on their sustainability reports and are providing broader assurance regarding their disclosures, according to a new report from the International Federation of Accountants (IFAC), AICPA and CIMA. I found out that I am getting . Although the study is now an annual benchmark with data for 2022, the use of different sustainability standards and frameworks ensures that investors, lenders, and other stakeholders have a consistent and comparable We also found that finding sustainability information continues to be difficult.

overheard

“If everyone is not pretty much on board, the major powers may not act in a kind of cooperative sense. [then] They can cause big havoc elsewhere. ”

—Blackstone co-founder and CEO Stephen Schwartzman spoke at length about his concerns about AI during the panel At the FII Priorities Miami Summit, luck report. He also argued that AI has the potential to help criminals who would otherwise be less wise.