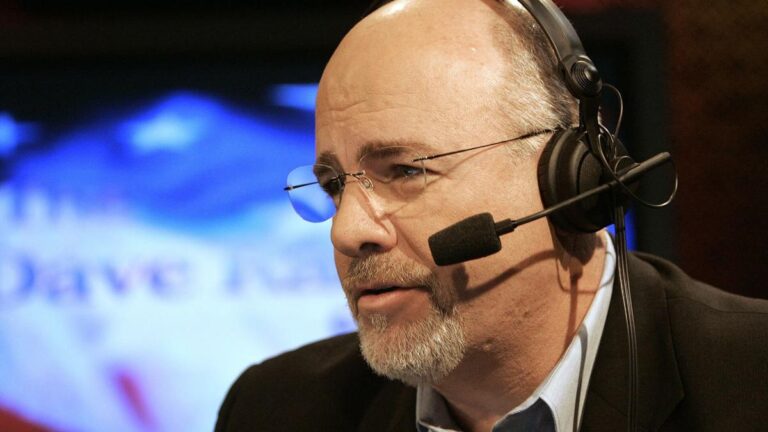

Everyone has someone they can turn to for advice. One such person for YouTuber Kate Caden, whose content focuses on frugal living, is financial expert and podcast host Dave Ramsey. In her YouTube video, she shared the following as the top three lessons Ramsey taught her about saving money:

Check out: Dave Ramsey: 7 Vacation Splurges That Are a Waste of Money

Read next: 6 genius things every rich person does with their money

sponsor: Do you owe the IRS more than $10,000? Schedule a free consultation to see if you qualify for tax relief.

make a budget

Kaden loves budgeting and agrees that this tip has saved her thousands of dollars in unnecessary expenses. Not everyone likes creating a family budget, but the act itself is very simple and easy.

First, calculate your monthly expenses and expenses using a spreadsheet. Next, separate your needs from your wants and set small, achievable goals to reduce your spending. Looking at your spreadsheet as your accountability partner will give you a clearer picture of how your money is being spent and where to make adjustments as needed.

Kaden advises creating your own budget each month. “Making a budget has been the key to reducing stress, getting better results, and feeling in control of your money. You know where every dollar goes, so you don't have to worry about confusion or wastage. “I don’t have to worry about it,” she said.

Learn more: This is the type of debt that 'scares' Dave Ramsey

get out of bad debts

The second lesson is to get out of bad debt, such as car loans, student loans, and credit card loans.

If, like many Americans, you're caught in a web of credit card debt, consider transferring your high-interest credit card balances to a new card with a 0% initial interest rate. The interest savings alone from a new card can help you pay off your first loan for less. Remember to use your credit cards responsibly, by only spending what you can afford to pay at the end of the month, and by taking advantage of cashback and rewards programs to reduce your credit card spending.

However, the best way to get out of bad debt is to reduce your overall expenses and increase your income. “It's great that getting out of bad debt frees up a lot of money that can be put towards other things.” [like investments]” Kaden said.

Save up an emergency fund

The third lesson that helped Kaden was saving for an emergency fund. An emergency fund is there to save you when the unexpected happens. Because in an emergency, financial health is irrelevant. Kayden says the freedom an emergency fund provides is priceless.

Set aside extra money as often as possible to build your emergency fund. Also, if you don't think you have any money left to donate, consider reducing your expenses and directing this money to the fund, such as buying less coffee each week or eating more meals at home instead of eating out. Please consider.

GOBankingRates Details

This article originally appeared on GOBankingRates.com: Frugal Living YouTuber Kate Kayden: 3 Lessons I Learned from Dave Ramsey About Saving Money