Schulz

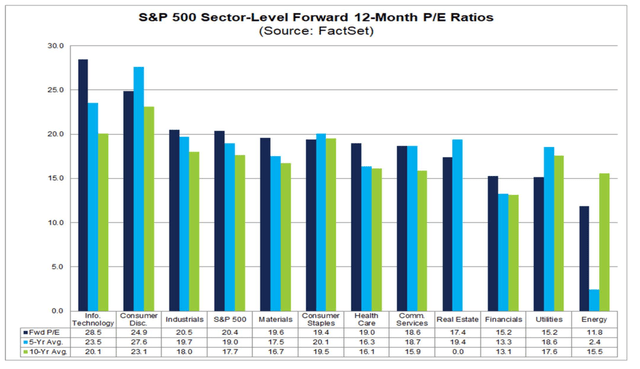

Sector valuations have changed over the past year. The information technology sector has benefited from the aura of AI, resulting in significant expansion. Other value and cyclical niches are just treading water with their respective P/E ratios. On the other hand, the evaluation of public utilities was significantly downgraded.area where trade was once carried out P/E ratios are in the high teens, but rising interest rates and tighter monetary policy are having a big impact on leveraged sectors.

I have a Hold rating on the Vanguard Utilities Index Fund ETF, as the past year's price action has been weak and I believe the valuation is just “fair” (NYSEARCA:VPU).

S&P 500 Sector P/E: Utilities rerating declines

fact set

by IssuerVPU seeks to track the performance of a benchmark index that measures the investment return of stocks in the utilities sector using a passively managed full replication strategy. Sampling strategies are also possible given regulatory constraints. The fund includes shares in companies that distribute electricity, water, and gas, or that operate as independent power producers.

VPU is a large-cap ETF with just over $6 billion in assets under management. Very low annual expense ratio of 0.10%. Income investors may be attracted to this index fund given its characteristics. The 12-month dividend yield remains high at 3.6%. As of February 21, 2024. Stock price momentum is very weak Over the past year, VPU returned -9%. Additionally, despite owning stable utility companies, the ETF has proven volatile on the downside recently. Low Risk ETF Grade by Seeking Alpha. Still, the fund Powerful liquidity indicatorsThis includes significant daily volume of 258,000 shares per Vanguard and tight bid-ask spreads of just 2 basis points on average.

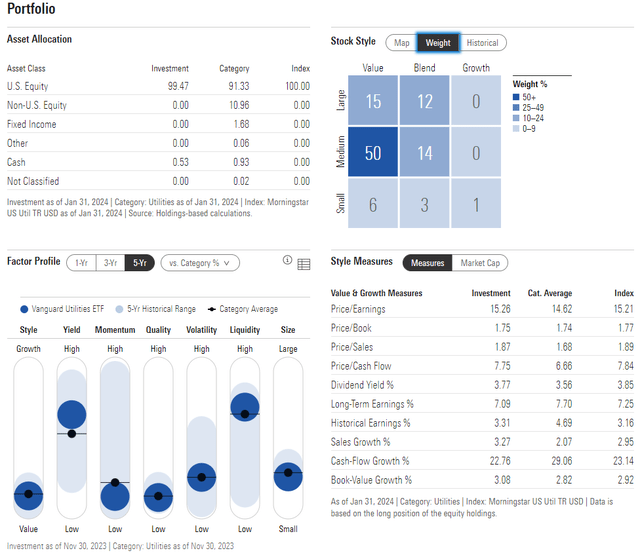

The 4-star Gold-rated fund by Morningstar has significant exposure to domestic mid-cap stocks and is plotted on the value side of the style box. Considering long-term earnings growth of just 7% and a P/E ratio of 15, the PEG ratio is not that cheap at around 2.0. Of course, investors may choose to overweight utilities due to the sector's high rate of return and safety during economic contractions.

Portfolio and factor profiles

Lucifer

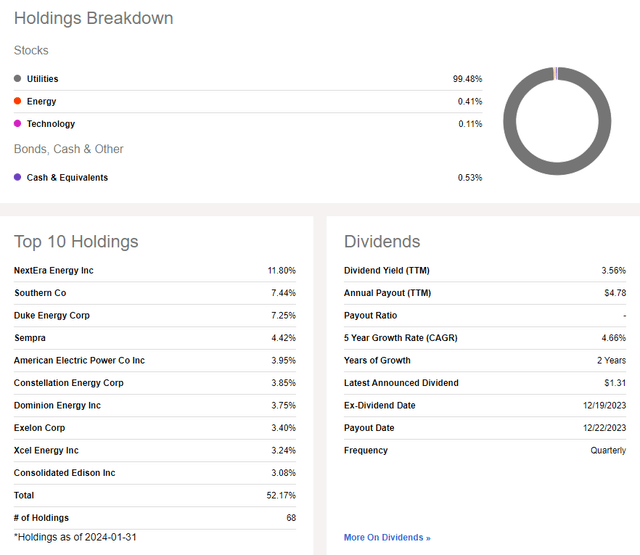

The main risk with VPUs is that they are highly concentrated. NextEra Energy (NEE) is by far the largest holding at nearly 12%. NEE has significant exposure to the renewable energy market and is highly sensitive to changes in interest rates. Overall, the top 10 positions account for more than half of the portfolio.

Stock holdings/dividend information

In search of alpha

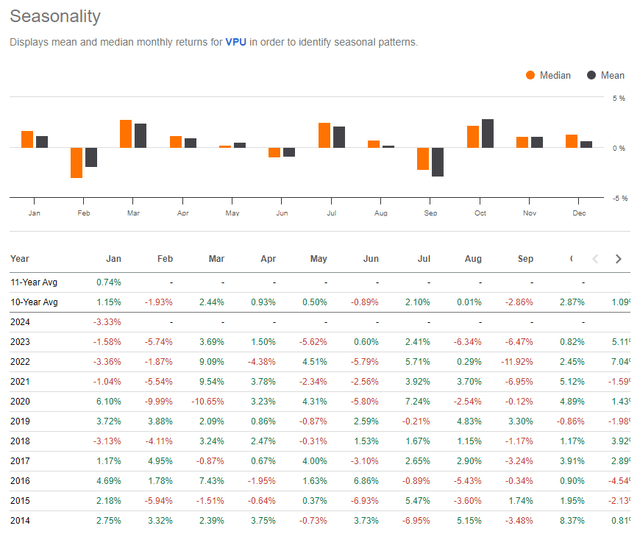

Seasonally, VPU tends to do well from March to May, approaching a bullish period on the calendar.

VPU: Bullish period from March to May

In search of alpha

technical view

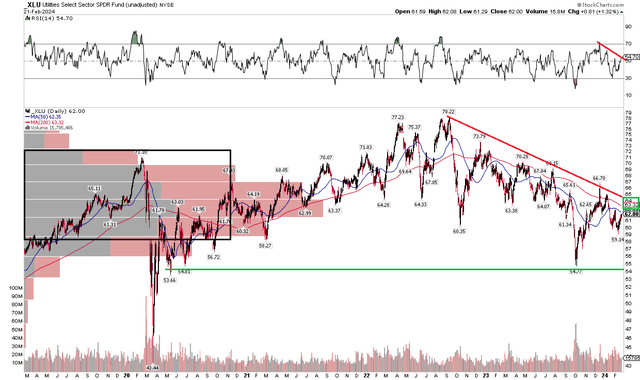

Lukewarm valuations, concentrated allocations, and bullish seasonal factors keep VPU stuck in a bearish downtrend from its all-time high recorded in Q3 2022. That's when interest rates started rising rapidly. Sector ETFs were able to withstand a temporary rise in bond yields, but continued high levels with no prospect of lower interest rates weighed on VPU. It's hard to be bullish on this ETF until it breaks above the key downtrend resistance line, currently in the mid-$60s.

Furthermore, the long-term 200-day moving average continues to decline around $63, suggesting that the bears are in control. Additionally, his RSI momentum gauge at the top of the graph tried to reach the rising mark, but declined as 2024 began. Finally, given the high price-specific volume from the mid-$50s to the low-$70s, we expect VPU to face selling pressure even if it moves higher from here. The October 2023 low of the mid-$50s is clearly support.

Overall, VPU remains in a bear market while the overall market is making new highs. I would like to avoid ETFs for now as they are weak both in relative and absolute terms.

VPU: Bearish downtrend, major support near $54

In search of alpha

conclusion

I have a Hold rating on VPU. I see its valuation today as approaching fair value ahead of a bullish seasonal period, but the technical picture is quite bearish.