Dakuku

My latest article on the JPMorgan Nasdaq Stock Premium Income ETF (NASDAQ:JEPQ), subscribers mentioned a less-discussed benefit of this fund, unlike most other dividend ETFs on the market. That is, this fund is an overweight technology.This makes it easy for investors to Combine JEPQ with more traditional dividend ETFs to create a balanced portfolio with appropriate technology exposure. Doing so reduces risk and volatility at the portfolio level, with long-term benefits for investors.

JEPQ's high dividend yield of 9.4% makes this fund a great income investment, and its heavy bias toward tech stocks should have interesting implications for many investors.

JEPQ – Strategy and Portfolio

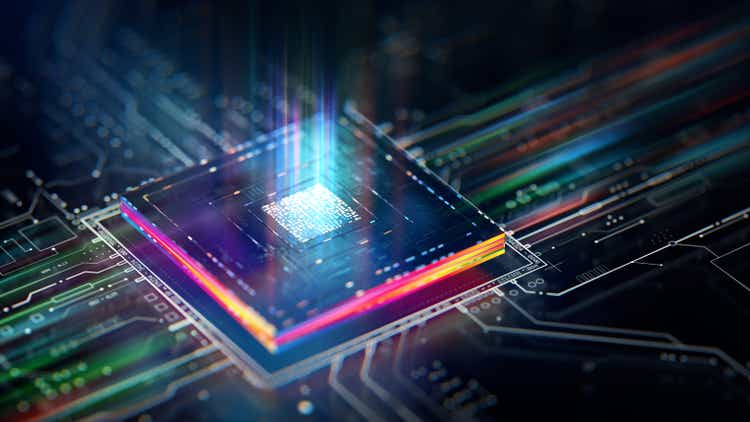

JEPQ is an actively managed fund that invests in Nasdaq 100 companies and indirectly sells covered calls on those companies through equity-linked notes, or ELNs. The fund's strategy is as follows.

JEPQ

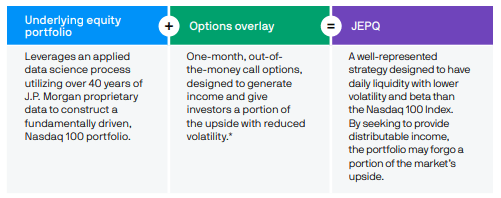

JEPQ invests in the largest companies in the Nasdaq 100 100 non-financial companies listed on NASDAQ. These companies are technology-heavy due to the exclusion of financials, midcaps, and some largecaps, as well as a significant overweight in some companies. specific Big technology companies including Microsoft (MSFT) and Apple (AAPL). The Nasdaq 100 index is more than 50% tech stocks, while the S&P 500 index is about 30%, which is a significant slope.

etfrc.com

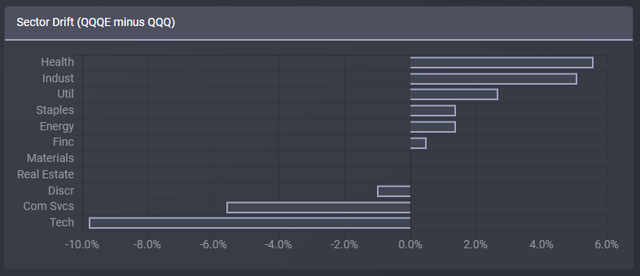

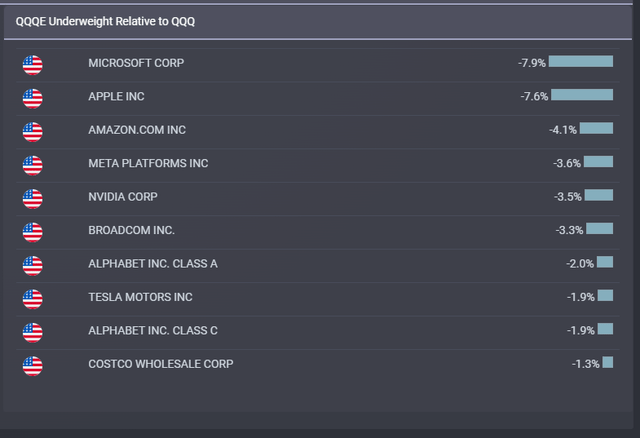

JEPQ is an actively managed fund, so security selection and portfolio weighting are at least partially investment discretionary decisions. The fund invests in Nasdaq 100 companies, but it may exclude some companies, invest in several others, or choose different weights than the index.From what I've seen, this fund does Wide It tracks indexes, but is slightly less overweight and mega-cap tech. Compare the industry slope of QQQE to the slope of the Nasdaq 100.

etfrc.com

Or that particular low weight position:

etfrc.com

While the numbers above are accurate, the fund's ELN complicates these issues. JEPQ's ELN is a leveraged derivative that combines the economics of investing in the Nasdaq 100 Index and selling call options on that index. These represent about 15% of the fund's portfolio, which influences the numbers above and probably exaggerates the difference between JEPQ and the index.

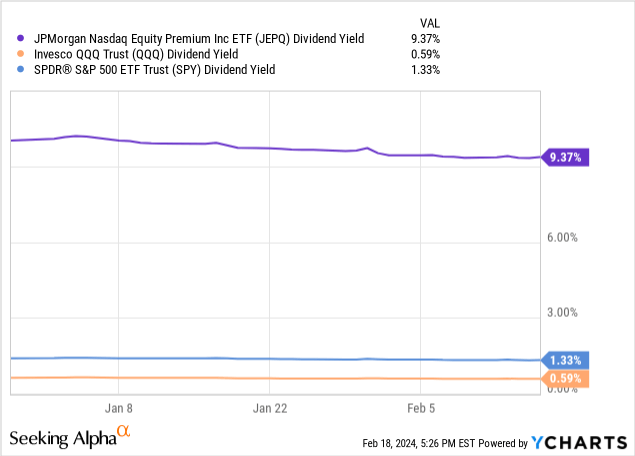

More broadly, JEPQ's ELN makes the fund a significantly different investment from a traditional Nasdaq 100 index ETF than any small difference in securities or weights. JEPQ's ELN primarily generates significant income through (indirect) option premiums. These are distributed to shareholders, giving the fund a yield of 9.4%. many It is higher than the NASDAQ 100 index and S&P 500 index.

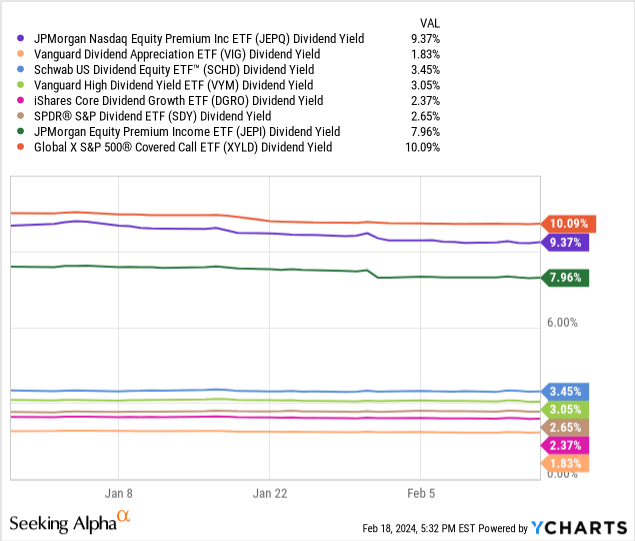

It also has a much higher yield than many large-cap dividend ETFs, but on par with other covered call ETFs.

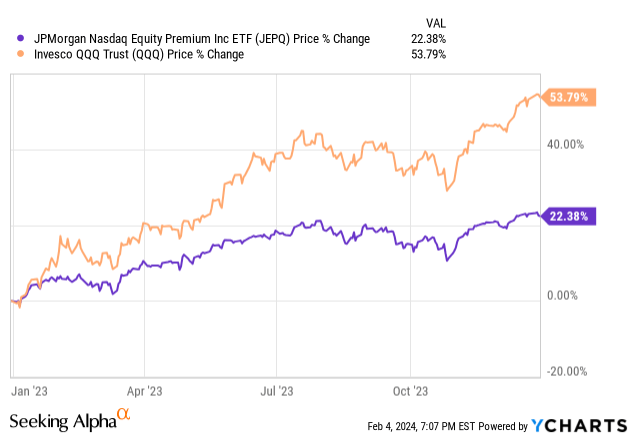

Investors give up a significant portion of their potential capital gains in exchange for a large income. As an example, JEPQ's stock price rose 22.4% in 2023, during which time the Nasdaq 100 index rose 53.8%. Capital gains were about half of the index, in line with expectations. We expect a similar outcome in the upcoming bull market.

Data by YCharts

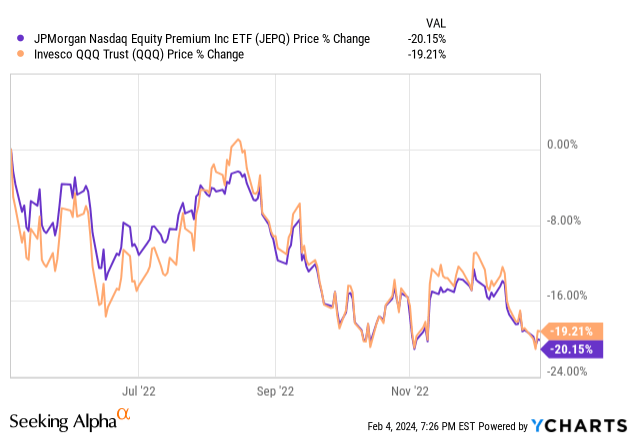

Importantly, JEPQ's ELN does not affect the fund's potential capital. loss. If stocks fall, as will be the case in 2022, losses similar to those of the Nasdaq 100 index are expected.

Data by YCharts

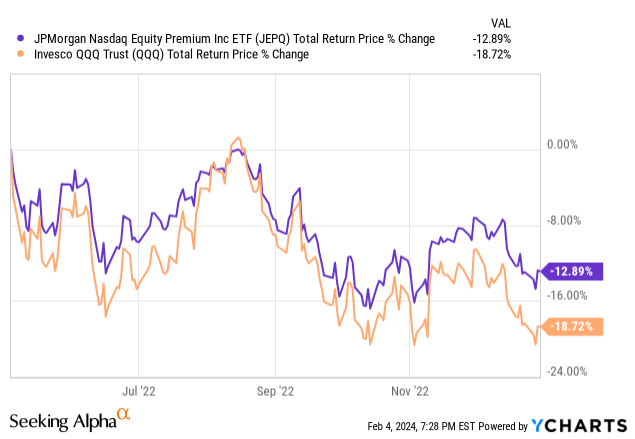

JEPQ's ELN is net positive because it generates revenue when the market is down or flat. Although JEPQ experienced similar capital losses in 2022, it outperformed the index due to higher dividends.

Data by YCharts

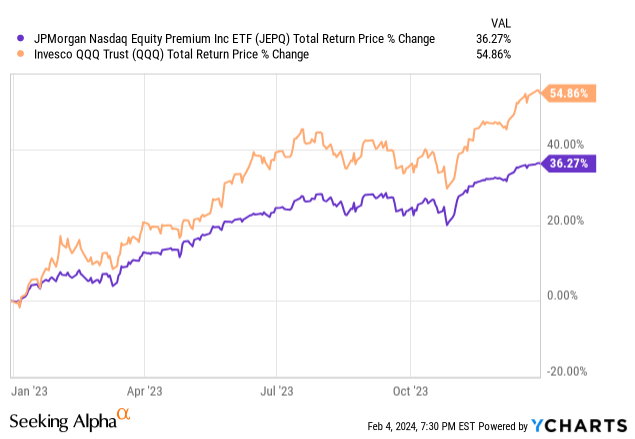

JEPQ's ELN will be net negative if the market is up significantly, reducing potential capital gains. JEPQ was found to underperform the index in 2022 many Capital gains are lower. A higher distribution helped narrow the gap, but it did not close it.

Data by YCharts

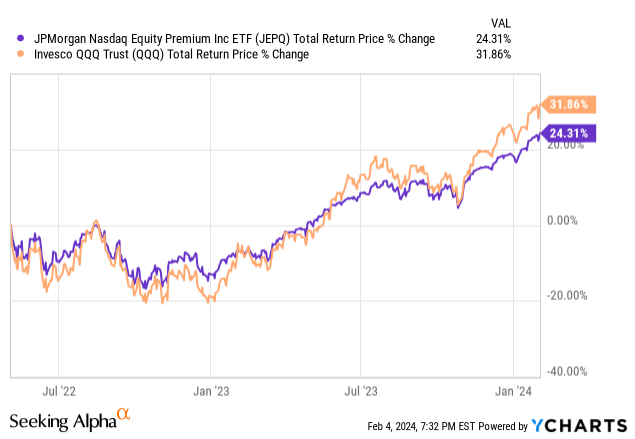

Overall, covered call strategies like the one employed by JEPQ tend to underperform slightly because the stock price mostly rises and because of the way these options are priced. JEPQ itself, as expected, has underperformed its index since its inception.

Data by YCharts

Overall, covered call ETFs like JEPQ are income investments that are willing to give up some of their long-term total return in exchange for higher dividends and the potential for outperformance in bear markets. It seems like a particularly interesting investment for homes and retirement. Importantly, most covered call ETFs, such as the JPMorgan Equity Premium Income ETF (JEPI) and the Global X Covered Call ETF Suite, have similar characteristics. JEPQ differs from most of these funds in one important way. Let's take a look.

JEPQ – Less-discussed benefits

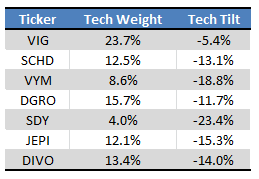

JEPQ is a medium weight technology company. Numbers vary. Etfrc.com says 10%; should It's even higher when you factor in ELN. Although the Nasdaq 100 itself is 20% overweight, the fund does not fully track the index. JEPQ seems to focus on technology by about 10% to 20% (which I would call a moderate amount). Most dividend ETFs and covered call ETFs are low weight Some of the biggest names include JEPI, Schwab U.S. Dividend Stocks ETF (SCHD), and Vanguard Dividend Appreciation ETF (VIG). There are few exceptions.

The tech industry is eyeing some of the larger dividend ETFs in the market.

Etfrc.com – Table by author

For the reasons listed above, and based on discussions with our readers and subscribers, many income investors and retirees are underweight technology.Originally there was nothing mistaken For this reason, some investors may prefer a more balanced industry exposure, especially in their portfolios. Investing in JEPQ can be used to accomplish this by simply combining JEPQ with other dividend ETFs. As an example, a 50/50 allocation to JEPQ/JEPI has a similar technology weight to the S&P 500.

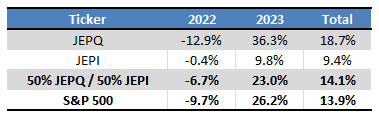

Balanced industry exposure provides some stability in returns, at least relative to the S&P 500, which is a direct benefit for investors. As an example, if we weighted JEPQ and JEPI equally, he would have had roughly similar returns to the S&P 500 in each of 2022 and 2023, and would have slightly outperformed the two years overall. Focusing solely on JEPQ would have resulted in higher losses in 2022, while focusing on JEPI would have resulted in significantly lower profits in 2023.

Seeking Alpha – Table by author

In this particular example, JEPI alone is even more unstable than JEPQ and JEPI, but I hope I've made the broader point clear.

By combining JEPQ with most other dividend ETFs, investors can create a portfolio with appropriate technology exposure, which should lead to big gains when technology outperforms. Many income investors missed out on the +20% rally in 2023 by being underweight in tech stocks. By investing in JEPQ, investors won't miss out on similar gains in the next tech bull market. The fund's yield is also 9.4%, so investors won't lose any income either.

As a side note, I'm not sure if the focus is on technology. right now This is a good idea since the valuation seems a little too high. Although some investors may disagree, JEPQ's technology exposure will likely lead to a more balanced portfolio in the long run. I would also be wary of giving too much weight to JEPQ, JEPI, and other covered call funds in your portfolio. These funds' premiums are highly dependent on option prices and stock volatility, and I don't want my retirement funds to depend on these arcane and volatile issues. Still, there are many other dividend funds out there, such as SCHD and VIG.

conclusion

JEPQ's high dividend yield of 9.4% makes the fund a great income investment, and its heavy bias toward tech investments should have interesting implications for many income investors and retirees.