XJ International Holdings Co., Ltd. (HKG:1765) shareholders will be happy to see the share price has increased 19% in the last month. But that's small consolation in the face of three years of shocking declines. The stock price sank like a leaking ship, dropping 89% in that time. Perhaps a recent recovery should be expected after such a severe decline. Only time will tell whether the company can sustain its turnaround. In this scenario, we have shareholders at heart. This is a good reminder of the importance of diversification, and it's worth bearing in mind that there's more to life than money anyway.

The recent 15% rally could be a positive sign of things to come, so let's take a look at the historical fundamentals.

Check out our latest analysis for XJ International Holdings.

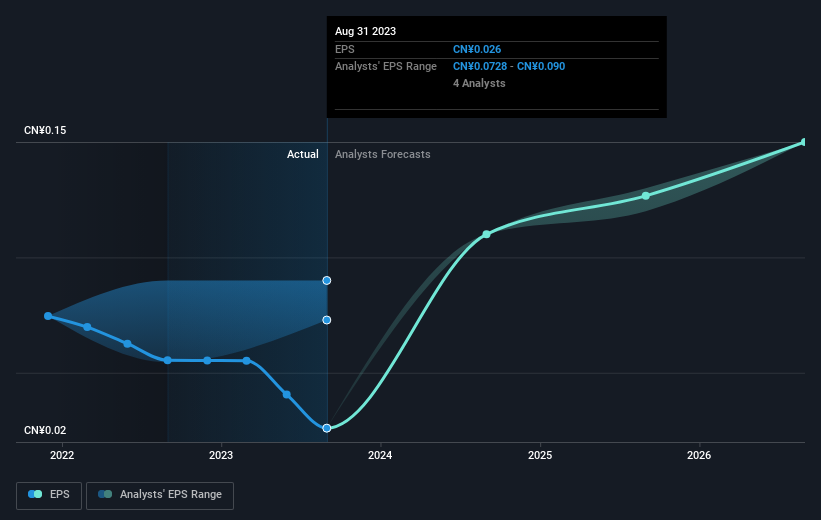

Markets are powerful pricing mechanisms, but stock prices reflect not only underlying business performance but also investor sentiment. One imperfect but simple way to consider how the market perception of a company has changed is to compare the change in the earnings per share (EPS) with the share price movement.

XJ International Holdings' EPS decreased at an average rate of 1.3% per year over the past three years. The share price decline of 53% is actually more steep than the EPS slippage. So it seems like the market used to have too much confidence in this business.

The company's earnings per share (long-term) are depicted in the image below (click to see the exact numbers).

It's good to see that there has been some significant insider buying in the last three months. That's a positive thing. On the other hand, we think revenue and profit trends are more important metrics for the business.this free This interactive report on XJ International Holdings' earnings, revenue and cash flow is a great starting point, if you want to investigate the stock further.

different perspective

We're disappointed to report that XJ International Holdings shareholders are down 51% over the year. Unfortunately, this is worse than the 15% decline in the overall market. That being said, it is inevitable that some stocks will be oversold in a down market. The key is to keep an eye on fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the 11% annualized loss over the past five years. Generally speaking, long-term stock price weakness can be a bad sign, but contrarian investors may want to research the stock in hopes of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we discovered that 3 warning signs for XJ International Holdings What you need to know before investing here.

There are plenty of other companies where insiders are buying up shares.I think that's probably the case. do not have I want to miss this free A list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we help make it simple.

Please check it out XJ International Holdings Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.