Fed officials have warned that they need more time to start cutting rates. That cautious view was reinforced by Tuesday's higher-than-expected inflation rate.

Investors are starting to listen. Markets are now pricing in a nearly 80% chance that the Fed will cut rates in June, pushing back on previous expectations that they would start cutting rates in May.

The change followed the Bureau of Labor Statistics' announcement on Tuesday that the Consumer Price Index (CPI) rose 0.3% in January from the previous month and 3.1% from a year earlier.

Both indicators were higher than economists expected. On a “core” basis, excluding volatile food and gas prices, prices in January rose 0.4% from the previous month and 3.9% from a year earlier.

The core number remains twice the Fed's 2% target.

“The long-awaited CPI report is a disappointment for those who were hoping for a modest decline in inflation and an early start to rate cuts for the Fed,” said Quincy Crosby, chief global strategist at LPL Financial.

“The overall numbers were better than expected and ensured that more data is needed before the Fed begins its rate cutting cycle.”

Claudia Sahm, founder of Sahm Consulting, told Yahoo Finance on Tuesday that the Fed “has a lot to think about.”

Federal Reserve officials have been trying to signal for the past month and a half that the rate cuts will likely come later than some investors expected.

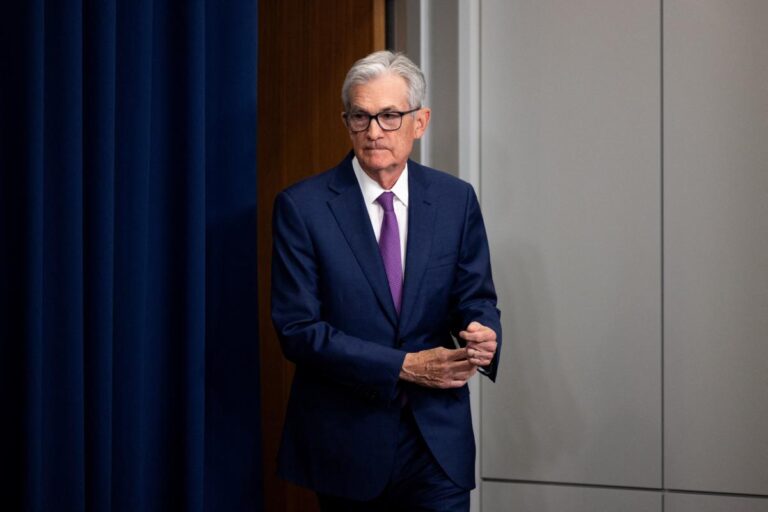

Federal Reserve Chairman Jay Powell made this point at a press conference on January 31, saying officials wanted to see better data and gain greater confidence about the direction of inflation before easing monetary policy. He said he was thinking of doing so.

“We're not looking for better data…we're looking at a continuation of good data,” he said. “We have six months of good inflation data. The problem is that six months of good inflation data sends a real signal that we are actually on a sustainable trajectory to 2% inflation. The question is, is it true?”

Some economists said the Fed would be more confident if full-year inflation data showed a decline toward 2%. That would mark June.

Investors started thinking more aggressively this year, anticipating the first rate cut in March. Their hopes were dashed when Mr. Powell essentially took it off the table in a Jan. 31 news conference and Feb. 4 appearance on “60 Minutes.”

Other Fed officials also urged patience in a series of speeches last week. Richmond Fed President Tom Barkin said it would be wise for the central bank to “take its time” in cutting interest rates, despite “remarkable” data showing inflation is falling.

Boston Fed President Susan Collins and Cleveland Fed President Loretta Mester also said last week that further conditions are needed before they can be confident that inflation is returning to the central bank's 2% target, adding that “this year… It was predicted that it would likely be in the second half.

Atlanta Fed President Rafael Bostic told CNN on Monday that he expects a rate cut “sometime in the summer.”

Shelter prices, which are closely monitored by authorities, contributed two-thirds of the monthly increase reported on Tuesday. At the same time, prices for services excluding shelter prices, which tend to take longer to fall, were flat at 3.6% last month, in line with the 3.5% range of the past few months.

While the CPI showed little sign of progress last month, the Fed's preferred inflation measure, the “core” consumer spending index that excludes volatile food and energy prices, rose 2.9% in December. It was shown that it is increasing further. Improved than CPI. Officials plan to take another reading of that gauge later this month.

The Fed's emphasis on prudence means it is more likely to back away from considering rate cuts as we approach the second half of the election year.

That has led to a clash between figures on both sides of the policy divide who are prepared to attack Mr. Powell if the cuts are too fast or slow for their liking.

Those critics include Republican front-runner Donald Trump, who said that Powell “looks to me like he's probably trying to lower interest rates to get people elected.” Stated.

“This is going to be a tough year for the Fed. The Fed is already taking steps on all fronts,” Sahm told Yahoo Finance on Tuesday.

But he said he expects Fed officials to keep their heads down and “do their jobs.”

For the latest stock market news and in-depth analysis of price-moving events, click here.

Read the latest financial and business news from Yahoo Finance