In this article, we look at the top 12 stocks to buy in 10 different sectors over the next three months. If you would like to skip the introduction to how diversifying your portfolio across sectors can help long-term performance, according to financial literature, please visit the following link: Top 5 stocks to buy in 10 different sectors over the next 3 months.

The proliferation of technology and widespread use of the Internet by people from all walks of life has greatly increased people's exposure to information. This also applies to politics, sports, and finance. Whether you work in these industries or whose well-being is tied to your performance, you can stay up to date with the latest trends. Social media stocks like Meta Platforms, Inc. (NASDAQ: META) and private companies like Elon Musk's famous His Enabling a world of prepared people.

For example, if you want to learn from someone who spends the majority of their day doing finance-related things, you can always check out Twitter. Diversity is important when risking money in stocks, and another common way to hedge risk in an investment portfolio is through diversification. In finance theory, diversification reduces the differences that a broader portfolio's returns may face. In other words, it can reduce sharp downsides that can significantly reduce principal value if an adverse event occurs in an industry, giving investors peace of mind and optimizing cardiovascular performance. You can increase your sexuality.

Additionally, the vast amount of information available to investors through the internet and traditional media also allows them to quickly adjust and adjust their investments in response to news. For example, all major stock indexes such as the Nasdaq, S&P 500, and New York Stock Exchange fall when the Federal Reserve surprises investors by raising interest rates, and rise when macroeconomic and political stability is guaranteed. It only takes a few seconds. When it comes to investing in stocks in different sectors, savvy investors can easily keep up to date with the performance of disparate sectors, such as high-tech/biotech stocks or good old oil/crude. Masu. Exploration and production inventory.

Even if we ignore the complex mathematical intricacies of standard deviation and other variables that experts rely on when investing in stocks in different sectors, it makes sense on an intuitive scale to do so. I think so. For example, let's see how this works by considering two different sectors and recent stock market events. After Russia invaded Ukraine in 2022 and the Federal Reserve began raising interest rates in response to record inflation levels, the polarization of the stock market into different sectors became apparent. One of his areas, oil and energy, was briefly discussed above, but the second area is technology. After the Russian invasion and the Federal Reserve's latest rate hike cycle officially subsided, oil stocks soared as investors rightly realized they stood to benefit from the upheaval in the global oil industry.

At the same time, tight macroeconomic conditions caused by high interest rates and high inflation have doubled the value of high-priced technology and high-growth stocks such as Metaplatforms Inc. (NASDAQ:META) and Tesla Inc. (NASDAQ:TSLA). Or 1x. Stock market losses reach triple digits. For investors who were smart enough to invest in a variety of sectors at the start of 2022, the impressive returns and dividends offered by oil stocks could have helped ease or even reverse the pain experienced by technology stocks in 2022.

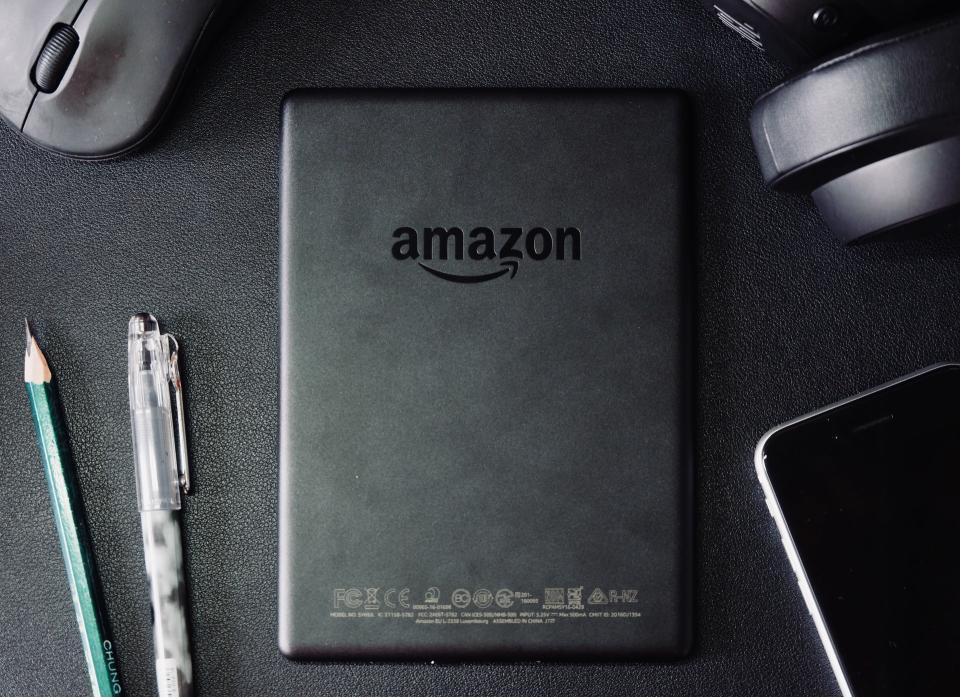

With these details in mind, let's take a look at some of the top stocks in different sectors. Stocks to watch include Amazon.com, Inc. (NASDAQ:AMZN), Microsoft Corporation (NASDAQ:MSFT), and Meta Platforms, Inc. (NASDAQ:META).

Photo by Sunrise King on Unsplash

our methodology

To create a list of stocks to buy in various sectors, we scanned Insider Monkey's database of 910 hedge fund portfolios, including technology, materials, real estate, financial services, healthcare, industrials, communications, consumption cycles, Consumer Defense, Utilities and Energy sector with the most hedge fund shareholders as of Q3 2023. From these, the stocks with the highest number of hedge fund investors were selected.

We used hedge fund sentiment for these blue-chip stocks in 10 different sectors. The top 10 consensus stocks selected by hedge funds have outperformed the S&P 500 index by more than 140 percentage points over the past 10 years (Please see here for the detail). That's why we pay close attention to this often ignored metric.

Top 12 stocks to buy in 10 different sectors over the next 3 months

12. American Tower Corporation (NYSE:AMT)

Number of hedge fund shareholders in Q3 2023: 60

Sector: Real Estate

American Tower Corporation (NYSE:AMT) is the real estate stock with the most hedge fund investors in our database. This may not be surprising since it caters solely to the needs of the technology industry. American Tower Corporation (NYSE:AMT) stock has an average rating of “Buy” and an average price target of $229.59.

In the third quarter of last year, 60 of the 910 hedge funds surveyed by Insider Monkey held American Tower Corporation (NYSE:AMT) stock. Charles Akre's Akre Capital Management was the company's largest hedge fund shareholder with an investment of $1.1 billion.

Similar to Microsoft Corporation (NASDAQ:MSFT), Amazon.com, Inc. (NASDAQ:AMZN), and Meta Platforms, Inc. (NASDAQ:META), American Tower Corporation (NYSE:AMT) is also a top stock in various sectors .

11. TECK Resources Limited (NYSE:TECK)

Number of hedge fund shareholders in Q3 2023: 75

Field: Basic materials

Teck Resources Limited (NYSE:TECK) is a mining company that produces coal, metals, and other products. The company has struggled financially recently, missing analyst EPS estimates in each of the last four quarters, especially amid the global economic slowdown due to the China crisis.

Insider Monkey examined the stock holdings of 910 hedge funds' portfolios in Q3 2023 and found that 75 companies held shares in the company. The largest stakeholder in Teck Resources Limited (NYSE: TECK) database is Eric W. Mandelblatt's Soroban His Capital Partners, which owns $433 million worth of shares.

10. T-Mobile US, Inc. (NASDAQ:TMUS)

Number of hedge fund shareholders in Q3 2023: 79

Department: Communication Services

T-Mobile US, Inc. (NASDAQ:TMUS) is an American telecommunications company headquartered in Bellevue, Washington. 2024 could be a big year for the company as it looks to expand its customer base further by partnering with SpaceX to provide satellite phone services.

As of the end of September 2023, 79 out of 910 hedge funds surveyed by Insider Monkey had purchased or owned shares of T-Mobile US, Inc. (NASDAQ:TMUS). Warren Buffett's Berkshire Hathaway held the largest stake, valued at $734 million.

9. ExxonMobil Corporation (NYSE:XOM)

Number of hedge fund shareholders in Q3 2023: 79

Sector: Energy

Exxon Mobil Corporation (NYSE:XOM) is the world's largest privately held oil exploration and production company. In February 2024, Exxon Mobil Corporation (NYSE: It's shaping up to be an important month for

In terms of stock holdings in Q3 2023, 79 of the 910 hedge funds tracked by Insider Monkey were investors in the company. Among them, the largest shareholder in Exxon Mobil Corporation (NYSE:XOM) is Jean-Marie Eveillard's First Eagle Investment Management with 13.1 million shares worth $1.5 billion.

8. Kenvue Inc. (NYSE:KVUE)

Number of hedge fund shareholders in Q3 2023: 85

Sector: Consumer Defense

Kenvue Inc. (NYSE:KVUE) sells over-the-counter healthcare, beauty and other related products. The company, which just went public, announced a first quarter dividend of 20 cents in February 2024, which was good news for investors.

Insider Monkey looked at 910 hedge funds' portfolios for stock holdings in the September 2023 quarter and found that 85 funds were buying Kenvue Inc. (NYSE:KVUE) stock. .

7. Union Pacific Corporation (NYSE:UNP)

Number of hedge fund shareholders in Q3 2023: 90

Sector: Industrial

Union Pacific Corporation (NYSE:UNP) is one of the oldest companies on our list, having been founded in 1862. The U.S.-based railroad company has an average stock rating of “Buy” with analysts' average target price. It's $256.44.

By the end of Q3 2023, 90 of the 910 hedge funds surveyed by Insider Monkey had invested in the company. Eric W. Mandelblatt's Solovan Capital Partners held the largest stake in Union Pacific Corporation (NYSE:UNP), valued at $1.6 billion.

6. Thermo Fisher Scientific (NYSE:TMO)

Number of hedge fund shareholders in Q3 2023: 109

Sector: Healthcare

Thermo Fisher Scientific Inc. (NYSE:TMO) is a diversified medical device company that sells equipment used in research, drug discovery, diagnostics, and other fields. The company announced tough news for investors in January 2024 when its full-year sales and profit forecasts fell short of analysts' expectations, due in part to weakening prospects for China's economic recovery.

At the end of September 2023, 109 of the 910 hedge funds tracked by Insider Monkey held shares in Thermo Fisher Scientific (NYSE:TMO). Chris Horn's TCI Fund Management became the company's largest shareholder with a $1.6 billion investment.

Amazon.com, Inc. (NASDAQ:AMZN), Thermo Fisher Scientific Inc. (NYSE:TMO), Microsoft Corporation (NASDAQ:MSFT), and Meta Platforms, Inc. (NASDAQ:META) are among the top hedge fund stocks. It is mentioned. Every field.

CTo read more and check out the top 5 stocks to buy in 10 different sectors over the next 3 months, click here.

Recommended articles:

Disclosure: None. Top 12 stocks to buy in 10 different sectors over the next 3 months Originally published on Insider Monkey.