(Bloomberg) — Asian stocks were mixed on Thursday after mainland Chinese stocks were volatile in the final trading day before the New Year holiday. Meanwhile, the S&P 500 closed at an all-time high.

Most Read Articles on Bloomberg

Chinese indexes swung in early trading after China's securities regulator was replaced on Wednesday, an unexpected move that could portend stronger measures to support stock markets. was.

Consumer prices in China fell last month at the fastest pace since the global financial crisis, as the world's second-largest economy struggles to eliminate persistent deflationary pressures. Alibaba Group Holding Ltd.'s shares fell about 7% in Hong Kong even as the company announced a $25 billion share buyback.

Stock indexes in the region rose for the third consecutive day. Indices for Australia and South Korea rose, but Japan rose as the yen weakened following remarks by Bank of Japan Deputy Governor Shinichi Uchida. He said it was unlikely that the central bank would continue to raise interest rates rapidly even after negative interest rates ended.

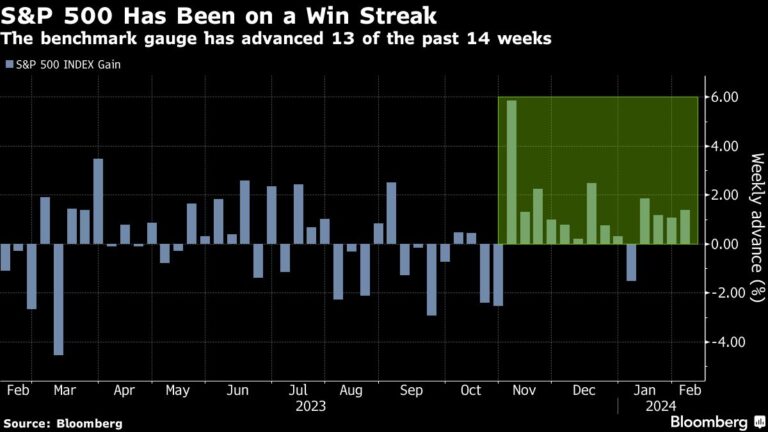

U.S. futures were little changed after the S&P 500 rose 0.8% on Wednesday to within range of 5,000 index points, as traders said they believed a strong economy would continue to drive corporate profits.

In Asian trading, U.S. Treasuries were mostly flat, with 10-year notes down slightly from the previous session. A record $42 billion in bids on Wednesday sold at lower-than-expected yields, a sign of strong demand and the market likely to struggle to digest the large supply. Concerns about whether or not this is the case have allayed.

“The market continues to climb a wall of uncertainty, including changing Fed expectations, geopolitical tensions, and overbought market conditions,” said Mark Hackett of Nationwide Funds Group. “Although we are entering a downturn, there is strong momentum in the market.”

In Asia, Japan's December current balance was lower than expected. Elsewhere, India's central bank is expected to make its latest monetary policy decisions. Markets in Taiwan, Indonesia, Vietnam and Pakistan are closed. The region's results include Honda and SoftBank Group, and it is expected to be one of the best quarters in years.

Arm Holdings, in which SoftBank owns a stake, rose as much as 38% in after-hours trading in New York after strong results, while SoftBank rose in Asia. U.S. semiconductor stocks in the S&P 500 index rose 2.1%, outperforming the broader market, helped by Nvidia's 2.8% rise.

Renewed concerns about US regional banks appear to have eased, supporting a tentative risk-on tone in New York markets. New York Community Bancorp stock reversed a 14% intraday decline to end higher.

On Wednesday, more Fed officials indicated they didn't think a rate cut was urgently needed, and in recent days have warned that a rate cut likely won't happen until May at the earliest. He was added to a list of policymakers, including Chairman Jerome Powell.

In commodity markets, gold reversed Wednesday's modest losses to trade at around $2,037 an ounce. Oil prices rose, with West Texas Intermediate futures rising in early trading in Asia, adding to Wednesday's 0.8% rise.

This week's main events:

-

U.S. wholesale inventories, new unemployment claims, Thursday

-

Treasury Secretary Janet Yellen speaks Thursday at the Senate Banking Committee's hearing on the Financial Stability Oversight Council Annual Report.

-

Pharmaceutical CEOs speak Thursday before the Senate Committee on Prescription Drug Pricing

-

ECB chief economist Philip Lane speaks on Thursday

-

ECB releases economic news on Thursday

-

US CPI revisions Friday

-

German Consumer Price Index, Friday

-

President Joe Biden hosts German Chancellor Olaf Scholz at the White House on Friday.

The main movements in the market are:

stock

-

S&P 500 futures were little changed as of 11:03 a.m. Tokyo time.

-

Nikkei 225 futures (OSE) rose 1.4%

-

Japan's TOPIX rose 0.3%

-

Australia's S&P/ASX 200 rose 0.6%

-

Hong Kong's Hang Seng hasn't changed much.

-

The Shanghai Composite rose 0.7%.

-

Euro Stoxx50 futures rose 0.2%

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was almost unchanged at $1.0781.

-

The Japanese yen fell 0.1% to 148.33 yen to the dollar.

-

The offshore yuan rose 0.1% to 7.2049 yuan to the dollar.

-

The Australian dollar rose 0.1% to $0.6529.

cryptocurrency

-

Bitcoin rises 1.1% to $44,669.25

-

Ether rose 0.5% to $2,441.59

bond

-

The 10-year Treasury yield fell 3 basis points to 4.09%.

-

Japan's 10-year bond yield remains almost unchanged at 0.700%

-

The Australian 10-year bond yield rose one basis point to 4.10%.

merchandise

-

West Texas Intermediate crude rose 0.3% to $74.09 per barrel.

-

Spot gold rose 0.1% to $2,037.73 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Tassia Sipahutar.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP