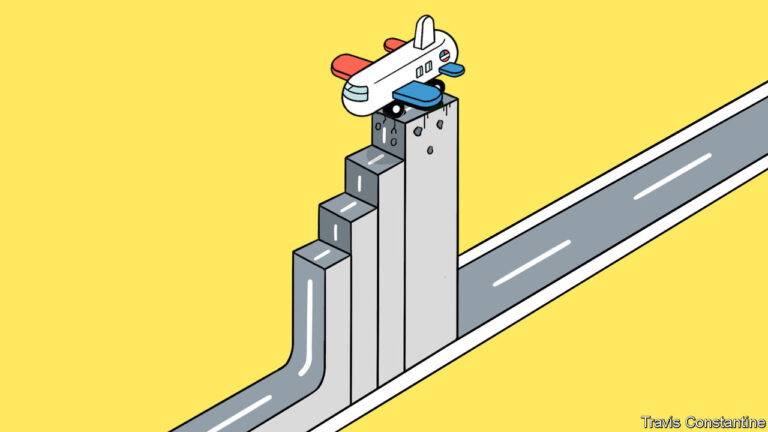

aamerican stock market I'm in tears. In the last 3 months S&P The Large Companies 500 index rose nearly 15%, hitting a record high (see Figure 1). Recent economic data supports investors' optimism. The Labor Department reported on February 2 that 353,000 jobs were created in January, far more than expected. The economy grew steadily at 3.3% (annual rate) in the final quarter of 2023. Nevertheless, inflation slowed to 2.6% due to the Federal Reserve's priority actions, not far from its 2% target. Investors are now betting that by the end of the year, the Fed will lower the benchmark interest rate from the current 5.25% to 5.5% range to below 4%, giving the U.S. economy, and with it, a major boost to the American economy.

However, this bet is by no means certain. On January 31, Federal Reserve Chairman Jerome Powell claimed that inflation was “still too high,” dashing hopes for an imminent rate cut. The interest bill on America's $21 trillion pile of non-financial corporate debt will continue to rise as cheap pandemic-era debt begins to mature. Profits are more or less stagnant. In the last quarter of last year, S&P Currently, 500 companies are reporting, but the increase was only modest at 1.6% compared to the previous year. Furthermore, the three forces that have supported profits may now be weakening.

One cause for concern is American consumers. Some of the fuel that sent consumption soaring and confounded predictions of a 2023 recession is running out. A recent paper by the Federal Reserve's Francois de Soir and co-authors found that most of the excess savings that shoppers accumulated during the pandemic have now been spent, thanks in part to government stimulus checks. It is said that there is Credit card default rates are steadily rising. Student loan repayments, which resumed last October after the pandemic-era Supreme Court overturned a moratorium, have added to the pressure on household budgets.

As a result, general goods peddlers are bracing for tough times. On January 23, furniture e-commerce company Wayfair announced it would lay off 13% of its staff in response to “persistent category underperformance.” It comes just weeks after the company's boss sent a touching Christmas note to staff praising the “joy of long hours”. ” and “integration of work and life.” On January 25, Levi Strauss, the popular American jeans maker, said it expects sales growth this year to be 1% to 3%, lower than analysts expected, and will lay off 10% to 15% of its employees. Announced. Home appliance manufacturer Whirlpool announced on January 30 that it expects sales to be flat in 2024.

On the same day, Mary Barra, president of General Motors, America's largest automaker, cheerfully predicted that U.S. car sales would increase 3% this year, not bad, but 12 percent higher than last year. This was significantly lower than the % increase. And as automakers digest higher costs from new wage deals won by unionized workers late last year, prices fall to boost demand, squeezing profit margins. It is expected that US consumers have also been slower to switch to more expensive electric vehicles (EVs) than the car manufacturer expected. January 24th, Tesla in America EV Champion warned that this year's growth rate “could be significantly lower”. The company's stock price fell 12% in response, wiping $80 billion off its market capitalization.

Even retailers of daily necessities are showing caution. Over the past two years, manufacturers of processed foods and household goods have been able to protect profits from rising costs by raising prices without crushing demand. That strategy has now stalled. On Jan. 26, toothpaste supplier Colgate-Palmolive said it expected sales to rise 1% to 4% this year, up from 8% last year. On January 30, confectionery maker Mondelez predicted sales growth in 2024 would be between 3% and 5%, up from 14% in 2023.

A second concern for some companies is the health of Chinese consumers. The collapse of the country's real estate sector is weighing on consumer sentiment. In December, Nike's stock price plunged after the company reported slowing sales growth in China as a result of “increasing macro headwinds.” The mood could worsen further after a Hong Kong court on January 29 issued an order forcing Evergrande, once China's largest property developer, into liquidation. The next day, Laxman Narasimhan, president of US coffee chain Starbucks, warned that China's “more cautious consumers” were weighing on the company's growth. iPhone maker Apple managed to post 2% year-on-year growth in the final quarter of last year, but sales in China fell 13%. For Apple, Nike and Starbucks, increased local competition is adding to the woes.

Back at home, the U.S. manufacturing boom also appears to be slowing, which is the third cause of concern for the year ahead. In the first half of last year, monthly U.S. factory construction jumped 17% after adjusting for inflation. In the second half of the year, this growth slowed to his 8% (see Figure 2). TSMCOn January 18, a Taiwanese semiconductor manufacturer announced that it would postpone the operation of its second semiconductor factory in Arizona by one to two years. The first edition in July had already been postponed. On February 1, it was reported that American semiconductor manufacturer Intel will postpone the opening of a factory in Ohio. This may be because the subsidies promised by the Biden administration are slow to materialize. Of the $52 billion specified in Chips ASo far, only a small portion of the funds have been allocated to support domestic semiconductor production. U.S. automakers are also postponing investment. EV Produced in response to disappointing demand. This could start to weigh on factory builders and suppliers who have benefited from the boom.

I think AI can do it.

One area of activity that shows no signs of slowing down is artificial intelligence (A.I.). Three American cloud computing companies, Amazon, Alphabet and Microsoft, reported year-over-year growth rates for their cloud divisions of 13%, 26% and 30% in the final quarter of last year, driven by increased demand from customers. This was a contributing factor. Technology that requires a large amount of computation. All three told investors of their lofty ambitions: A.I. This will likely lead to an increase in capital investment over the next year. Meta will also be in port on February 1st. A.I. Expressing ambition, reporting massive revenue and saying it will spend up to $37 billion this year, much of it on data center training and operations. A.I. model. In contrast to the company's previous investment binge in the unpopular virtual reality metaverse, investors repeated it with news that the company would buy back more shares and pay its first-ever dividend. The next day, Meta's market value soared nearly $200 billion to $1.2 trillion, the largest single-day jump in Wall Street history.

But it may be a while before the rest of America's companies see an improvement in profits. A.I.. According to a recent survey, BCG, a consulting firm says that only 5% of companies are not leveraging this technology at all. But 71% are simply “pursuing limited experiments and small-scale pilots.” With America running out of other fuels, more such pilots may be needed to ensure a smooth journey ahead. ■