(Bloomberg) — Securing approval for Gary Gensler’s ETF was just the first step in bringing cryptocurrency investing to the masses. Now, people like Rob Pettman of LPL Financial, the gatekeepers to over $1 trillion in capital, need to be convinced that the new Spot Bitcoin exchange-traded fund is a worthy addition to their massive trading platform. There is.

Most Read Articles on Bloomberg

A message from LPL executives: The next three months will prove critical in determining which new funding will be made available to the company's customers. Most importantly, there has been a series of infamous ETF closures throughout the industry's history as investment trends have changed.

As LPL's head of asset management solutions, Mr. Pettman leads the due diligence process for funds before they are added to the platform, which holds $1.4 trillion in assets overseen by financial advisors. There is.

“We just want to see how they perform in the market,” he said. After three months of evaluation, the platform will decide which funds it wants to offer or if it needs more time to evaluate the ETFs.

Like many gatekeepers in the money management world, Pettman is concerned with striking a balance between continuing to protect clients from risky investments and enabling them to reap the benefits of emerging asset classes. confronting. Some platforms, such as Fidelity and Charles Schwab, already have funds that RIAs can trade on behalf of their clients. Vanguard has no plans to launch its own Bitcoin ETF or allow existing funds to be traded through its intermediaries.

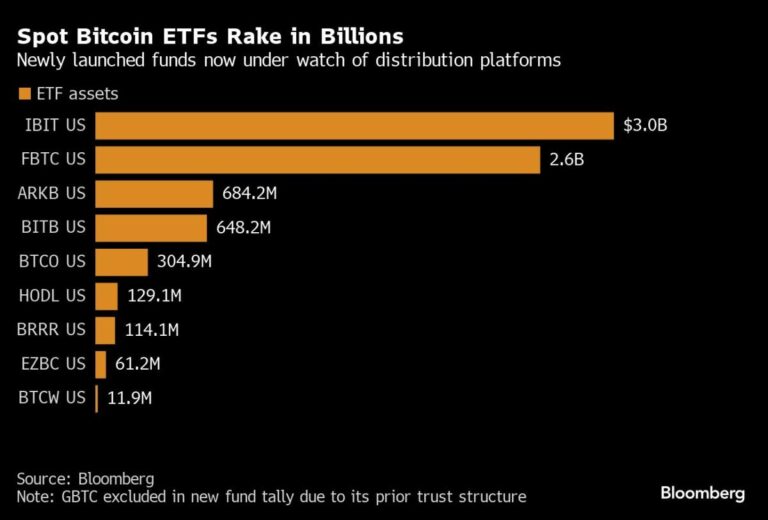

Currently, financial advisors using LPL can purchase Grayscale's GBTC ETF for their clients. This is because the fund existed in a trust structure and was available on the platform prior to conversion to an ETF. Nine other funds, including BlackRock's IBIT and Fidelity's FBTC, are under evaluation.

Pettman's main concern is that ETFs that don't accumulate large amounts of assets can be shut down frequently, creating headaches for advisors, investors and platforms like LPL.

“That can be a very negative experience for investors and financial advisors. It's also incredibly costly operationally for companies like ours to facilitate it.” He said. Therefore, LPL says, “You have to be careful about the products you put on your platform and make sure they're durable over time and have a good investment thesis.” That's ultimately when evaluating these. is the position we usually arrive at. ”

A huge number of ETFs closed last year because funds with pandemic-era temporary strategies were unable to maintain enough assets to operate. The average asset value of the 253 U.S. publicly traded companies that closed in 2023 was $34 million, according to data compiled by Bloomberg. These include the VanEck Digital Asset Mining ETF (DAM), which invests in stocks of companies involved in the cryptocurrency industry, and the Vault Crypto Industry Revolution and Tech ETF (BTCR), which invest in stocks of companies involved in the cryptocurrency industry. This included several funds.

It is too early to predict whether any of the newly listed spot funds will eventually be shut down. However, for now, the wealth gap is widening. At the top of the new product leaderboard is BlackRock's iShares Bitcoin Trust, which has already grown to $3 billion in assets. At the other end of the spectrum is his WisdomTree Bitcoin Fund, which has less than $12 million in assets.

“While the attention and interest in Spot Bitcoin ETFs has been unlike anything we have seen so far in the ETF world, the truth is that they are ETFs just like any other ETF, and this crowded It will face the same headwinds as any other ETF launch under the circumstances – it's a mature market,'' said Amrita Nandakumar, president of Vident Asset Management. “And if these funds are unable to meaningfully raise assets within a reasonable period of time, it would be no surprise to see some end up shutting down.”

The valuation process highlights the next stage in the Spot Bitcoin ETF race, which saw legal battles and fee wars unfold before the fund was approved by the SEC. Now, not only do fees make a difference in asset acquisition, market participants also determine how well a fund trades and the size of assets under management that a fund accumulates.

“Time will tell about the investment thesis,” LPL's Petman said. “And that's essentially what we're monitoring right now.”

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP