Last year's market was difficult to explain. While many experts are praising the industry for defying worst-case scenario predictions and emerging from the “housing recession” relatively unscathed, other real estate stakeholders are praising the industry for defying worst-case scenario predictions and emerging from the “housing recession” relatively unscathed. He pointed out that the company was struggling due to the inventory crisis. Both sides presented convincing evidence for their claims, but it remains to be seen by housing economists and industry luminaries how to characterize the market in 2023 and what to expect in 2024. There continues to be disagreement between the two.

But what about marketing? In a field that is notoriously difficult to track and quantify, numbers often reveal the truth. Has an agent or broker significantly changed his spending habits, channels, or targets in 2023? How have experienced real estate professionals adapted compared to those new to the industry? What types of companies? Which companies have withdrawn and which have increased?

Overall, companies believe 2023 will be a tightening year. Agents spent about 15% less on marketing their personal brands compared to 2022. For brokers, the drop was even more pronounced. Year-over-year he decreased by 24% and all external marketing expenses decreased by $12,000. However, the shift to internal marketing teams, which we discuss in Section 4, may explain at least some of this.

But interestingly, the agent actually spent more Revenue per listing in 2023 will be higher than in 2022, likely reflecting the increased competition in the market. In 2022, the agency spent an average of 3.2% on list price marketing, while in 2023 it was 3.7%.

There were also deeper changes in demographics. A new agent is investing more in his personal brand compared to his 2022, even though agents in almost every other category are cutting back on marketing costs. In his first three years, his agency spending was $2,760 in 2023 compared to $2,500 in 2022. Also, spending on market listings was even higher, increasing by 3.9% in 2023 from 2.6% in 2022.

As overall sales shrink and competition intensifies, emerging agencies taking on a larger share of marketing likely reflect more fundamental changes in the industry. But what about more experienced agents?

Companies with more than 15 years of experience cut their personal brand marketing budgets the most, at about 14%. As a percentage of list price, these agents paid slightly more to the market, up to 3.8% of list price in 2023 compared to 3.5% in 2022.

These more modest and cautious changes likely reflect the stability of more established business actors, who did not react as strongly or broadly to market changes in 2023 as newcomers.

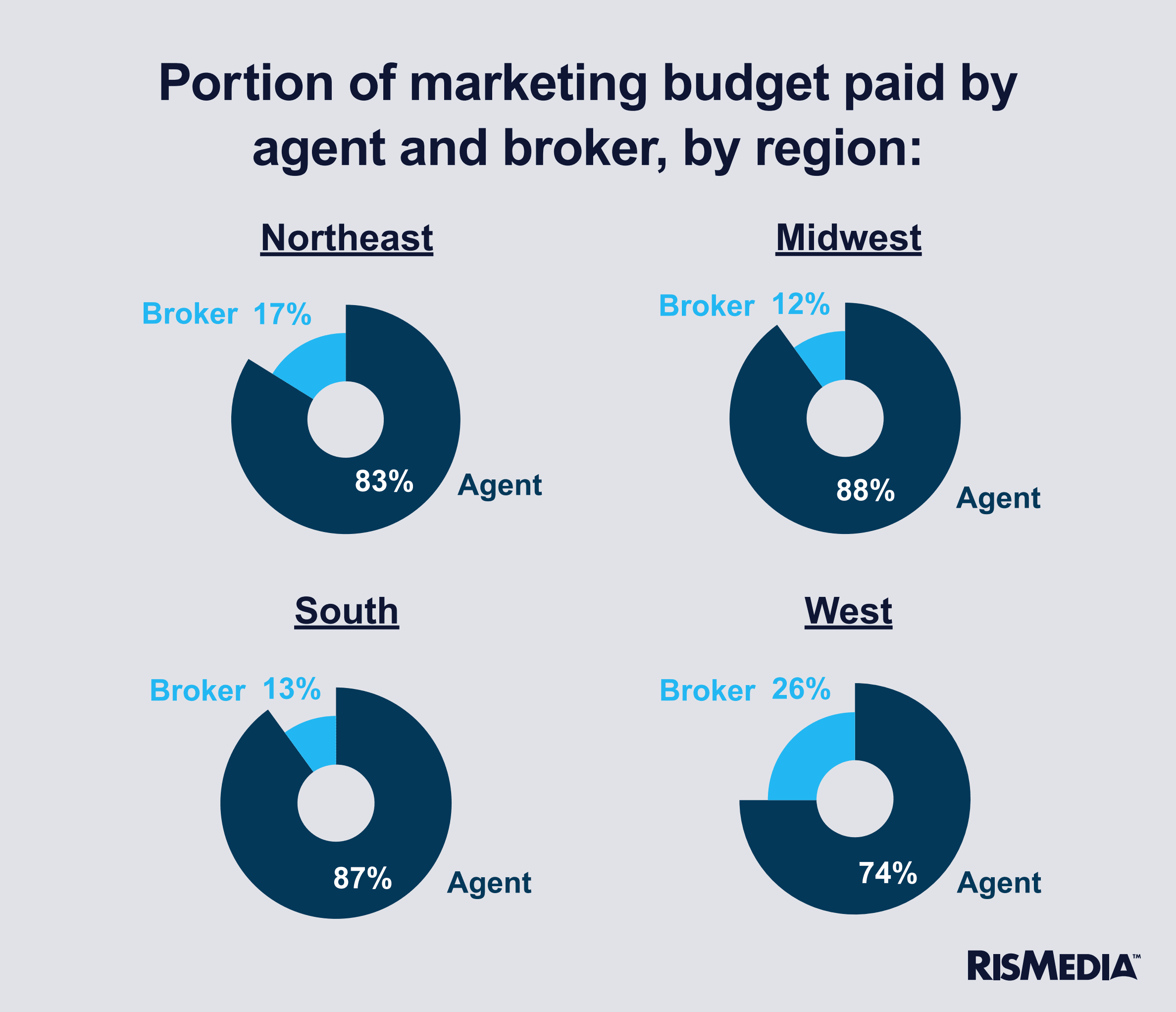

Notably, brokers and agents are still sharing marketing costs in the same proportions as in 2022, with agents paying an average of 85% and brokers paying 15%.

But again, this does not apply to new agents. Even though they spent more as a flat rate, they actually received more support from brokers in marketing expenses in 2023 compared to the previous year. Agents with less than three years in the industry paid only 68% of their total marketing budget, compared to 82% in 2022.

This strongly suggests that brokers are investing more in new agents and nurturing promising candidates. But strangely, even though brokerages are offering more support to less experienced agents, they are not investing marketing dollars in attracting or retaining agents.

Recruitment and retention budgets plummeted by just over half (55%), with brokers spending about $9,700 in 2023 compared to $22,000 in 2022. Again, there is some evidence that the move to in-house marketing services may explain some of this. However, recruitment and retention appear to be less important for brokers, which may reflect major changes in the industry.

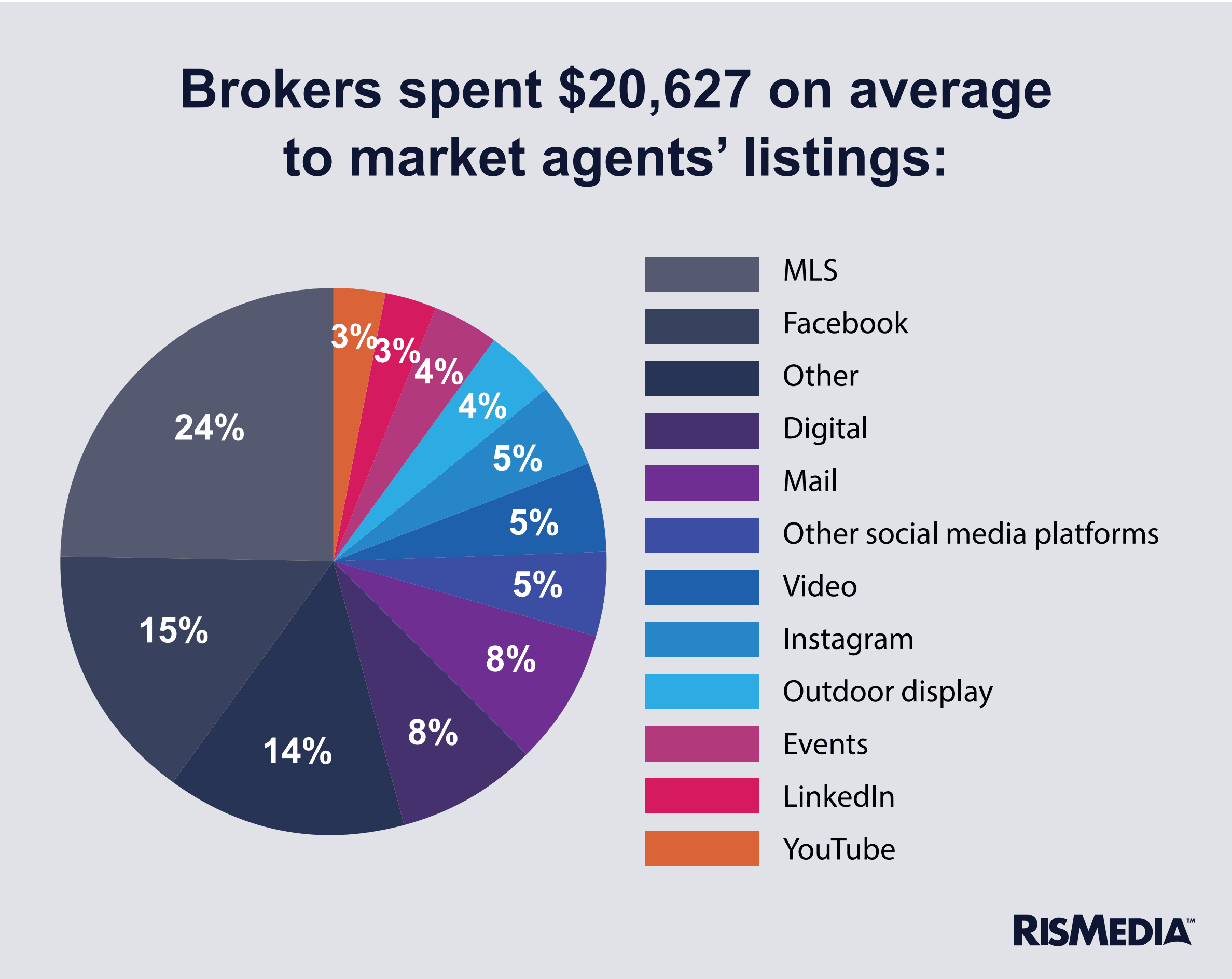

There were some other big changes from last year when looking at where agents and brokers are allocating their small budgets. When marketing listings, agents spent a higher percentage of their budgets on social media in 2023, nearly 22% (up from 17% in 2022). Facebook accounted for the majority of that, with agents spending 14% of their overall budget on the platform, followed by Instagram marketing at 4%.

Spending on MLS marketing and digital decreased slightly from 2022, with agents spending 20% on MLS and 9% on digital, down 4% and 3%, respectively.

Regarding personal brand, there was relatively little variation between agents. The biggest spend for an agent to promote himself remains social media, accounting for 25% of marketing spend (60% of which is spent on his Facebook). The popularity of the event increased slightly, increasing from 2% to 9% of the total budget.

The biggest variables in where agents choose to market appear to be age and experience. Younger agents (ages 18-54) were more likely to spend money on events and social media platforms other than Facebook (particularly her YouTube, TikTok, and Instagram). More experienced agents (those with 15+ years of experience in the industry) spend significantly more on print advertising and mail, over a fifth (21%) of their budget, compared to newer agents. is spent on mailers.

A simple interpretation of this is that older agents are less savvy with digital marketing, social media, or other channels that rely on technology, while more experienced agents have established their own ways of doing things and are more familiar with them than they were decades ago. You're still marketing in the same way. However, there is some evidence that this is not the whole story.

Experienced agents actually more They are more likely to invest in marketing their personal brand on Facebook than industry novices. They are also more likely to market themselves with digital advertising and tend to spend more on marketing content than new agents. Agents 65 and older also spend the same amount as younger agents on SEO and marketing their personal brand content, and they spend more on LinkedIn.

This distinguishes how these more experienced agents market their personal brand from other types of advertising compared to younger, less experienced agents who rely extensively on the same channels for most of their activity. It shows that there is. It's hard to say why without more qualitative data, but it seems clear that older agents are choosing traditional marketing channels more carefully than younger agents.

For listings, experienced agents spent significantly more of their budget on the MLS, 23%, compared to 13% for agents new to the industry. Overall, younger agents tended to spread their listing marketing costs across a wider range of channels compared to older, more experienced agents. Regionally, agents in the South and West prefer digital advertising for listings (spending 10% of their budgets compared to about 6% in the Northeast and Midwest), while print is less popular in the Midwest. , these agents decreased by 4% – 6. The budget there will be reduced by %.

Surprisingly, what type of company an agent worked for didn't seem to make a huge difference in where they spent their marketing dollars. Employees of national franchises spend more on printed materials to promote their personal brand, accounting for just over 14% of their budgets, compared to 10% for self-employed employees and 10% for self-employed individuals. His was 12%. Domestic franchise agents were also more likely to spend on mailings to promote their products.

Regions also led to significant differences in where and how much agents spent, but the trends and disparities were hardly surprising. Agents in the West spent an average of $11,300 on marketing their personal brands, more than twice as much as those in other regions. Agents in the West are also spending more on video, content marketing, and digital than in other regions.

This seems to clearly reflect the type of Western market: more expensive, upscale housing and an emphasis on lifestyle.

There are also regional differences in who pays for marketing, with the West and Northeast paying more for intermediaries than the Midwest and South.

Interestingly, the Midwest was the least likely to rely on social media compared to other regions, accounting for about 6% less of these agents' budgets. The Northeast also spent more on mail and print, as well as outdoor displays.