Understanding Ally Financial Inc's dividend trends

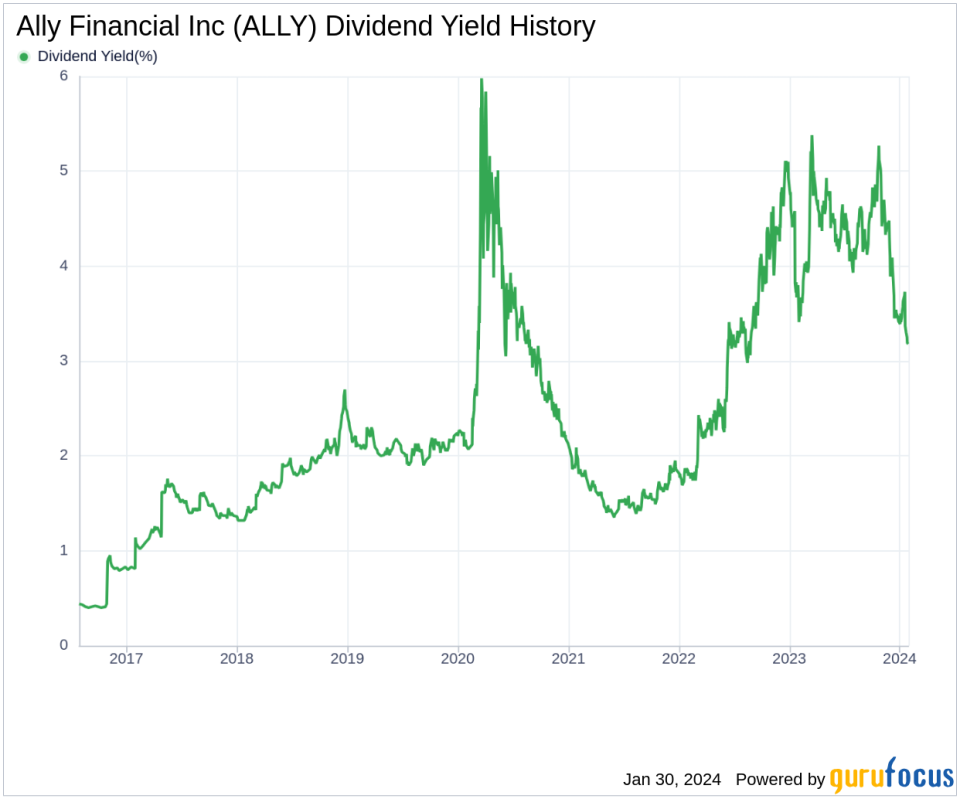

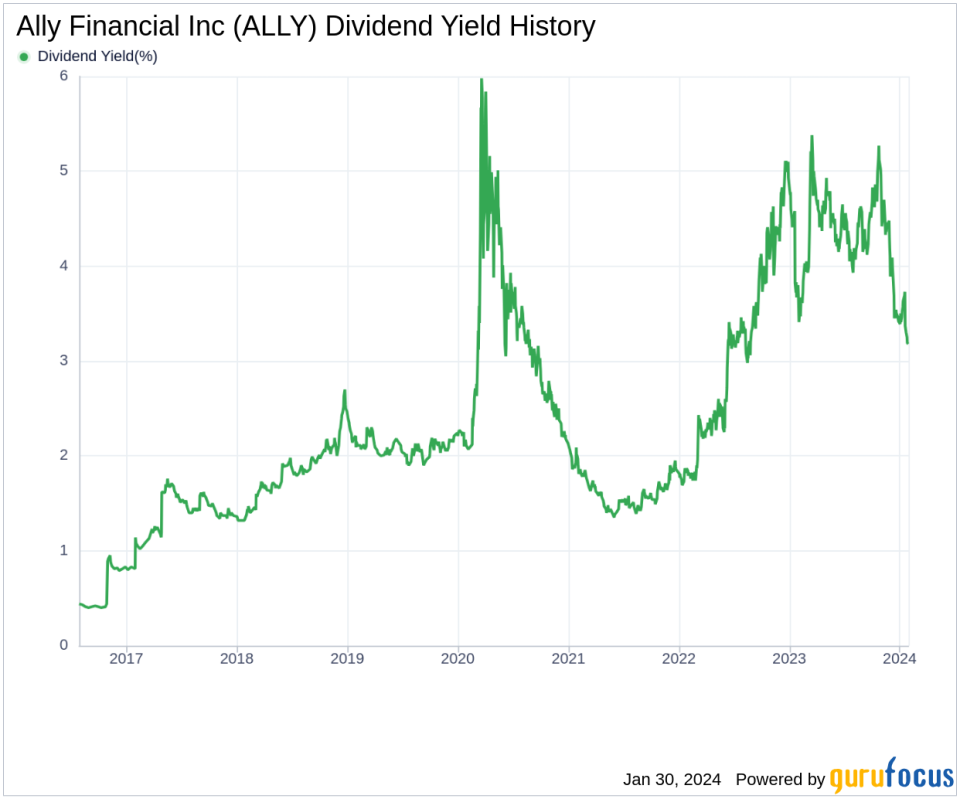

Ally Financial Inc (NYSE:ALLY) recently announced a dividend of $0.3 per share, payable on February 15, 2024, with an ex-dividend date of January 31, 2024. The company's dividend history, yield, and growth rate are also in focus as investors look forward to future payouts. Let's examine Ally Financial Inc's dividend history and evaluate its sustainability using data from GuruFocus.

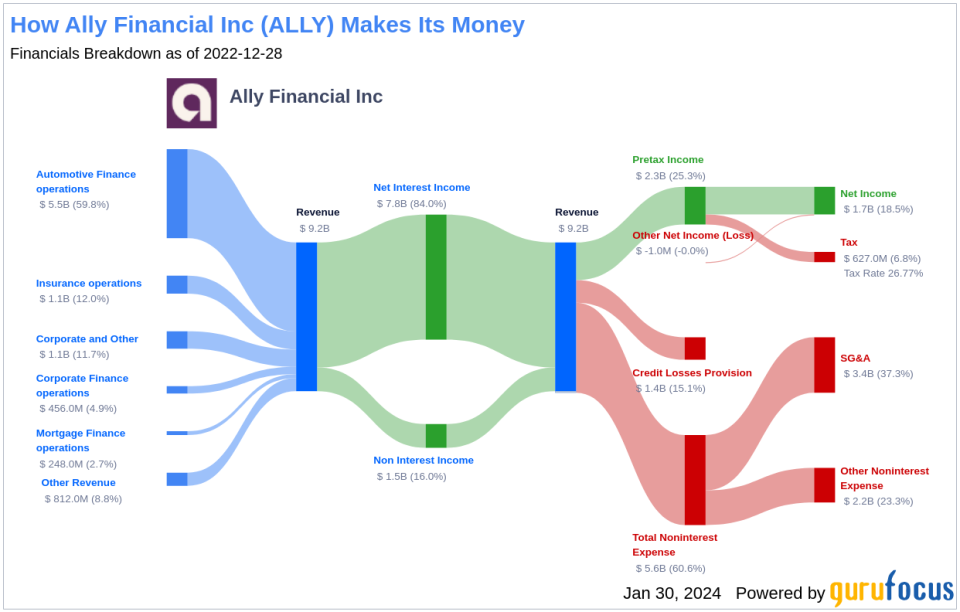

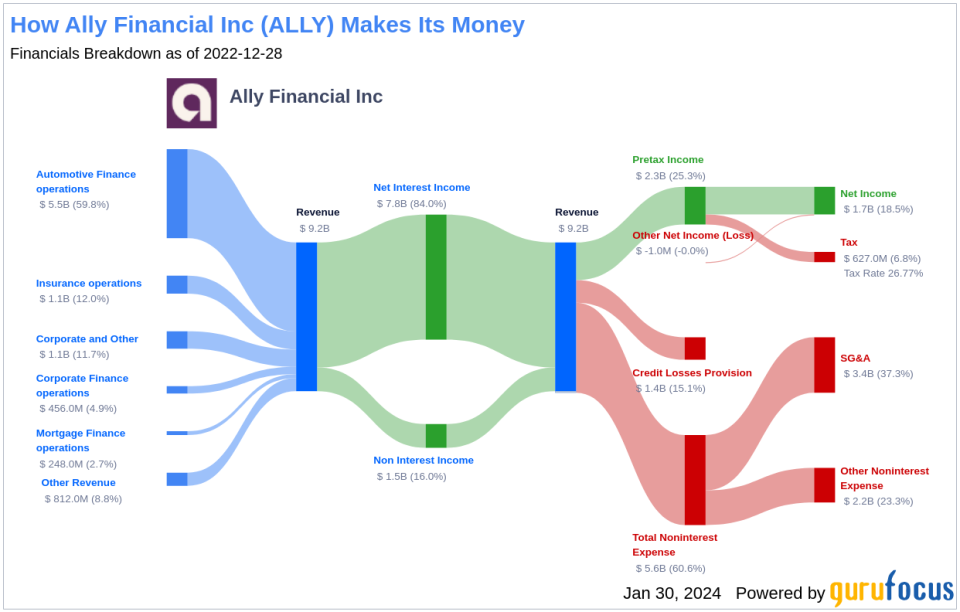

What does Ally Financial Inc. do?

Ally Financial Inc., formerly the exclusive financing arm of General Motors, became an independent, publicly traded company in 2014 and is one of the nation's largest consumer auto lenders. Although the company has expanded its product offerings over time, it remains primarily focused on auto loans, with consumer auto loans and dealer financing accounting for more than 70% of its loan balance. Ally Financial Inc also offers a wide range of financial products, including auto insurance, personal loans, commercial loans, credit cards, and has a portfolio of mortgage debt. The company's diversified business model is further enhanced by intermediary services, placing it well-positioned within the financial sector.

A glimpse of Ally Financial Inc's dividend history

Ally Financial Inc has maintained a consistent dividend payment record since 2016 and currently distributes dividends on a quarterly basis. Below is a graph showing annual dividends per share to track historical trends.

Analyzing Ally Financial Inc's dividend yield and growth rate

As of today, Ally Financial Inc's trailing 12-month dividend yield is 3.21% and its forward 12-month dividend yield is 3.21%, indicating that the stock is expected to have stable dividend payments over the next 12 months. Suggests. Ally Financial Inc's annual dividend growth rate over the past 3 years was 20.80%, which increased to 22.00% per year over 5 years. Based on Ally Financial Inc's dividend yield and 5-year growth rate, Ally Financial Inc stock has a 5-year cost yield of approximately 8.68% as of today.

Questions about sustainability: Dividend payout ratio and profitability

To assess dividend sustainability, you need to evaluate a company's payout ratio. Dividend payout ratio helps determine the proportion of a company's profits that it distributes as dividends. As of December 31, 2023, Ally Financial Inc's payout ratio is 0.38, indicating a balanced approach to dividend payments and retained earnings for future growth. Ally Financial Inc's Profitability Rank is 5 out of 10 as of December 31, 2023, indicating fair profitability. The company has reported positive net income in each of the past 10 years, further cementing its high profitability.

Growth indicators: future outlook

Ally Financial Inc has a growth rank of 5 out of 10, indicating a fair growth outlook. The company's earnings per share and his three-year earnings growth rate indicate a strong earnings model with earnings growing at an average annual rate of approximately 16.20%. This percentage is higher than about 72.54% of its global competitors. Ally Financial Inc's 3-year EPS growth rate and his 5-year EBITDA growth rate of 23.60% are also higher than a significant portion of its global competitors, indicating a high likelihood of continued dividend payments. is shown.

next step

In conclusion, Ally Financial Inc's consistent dividend payments, solid dividend growth rate, moderate payout ratio, fair profitability, and solid growth metrics paint a positive picture for current and potential investors. The company's financial health and strategic position suggest a sustainable dividend policy that will appeal to value investors looking for a stable income stream. As the financial sector continues to evolve, Ally Financial Inc appears well-equipped to navigate the challenges and opportunities ahead. Will Ally Financial Inc's dividend continue to be a reliable source of income for investors? Only time will tell, but current metrics are promising. If you're looking for high dividend yield stocks, GuruFocus Premium users can do further research with the High Dividend Yield Screener.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.