Summary of recent trades for Baillie Gifford (Trades, Portfolio)

On December 1, 2023, Baillie Gifford (Trades, Portfolio), a well-known investment management company, reduced its holdings in The Trade Desk Inc (NASDAQ:TTD) by 3,710,749 shares, a significant change of -8.30%. The we. This transaction has a -0.24% impact on the portfolio of Baillie Gifford (Trades, Portfolio), adjusting the company's total number of shares in TTD to 40,984,017 shares and increasing his position in the company to 2.68% of the portfolio and Changed to 9.18%. . The stock was sold at a price of $71.6 per share.

Baillie Gifford Profile (Trading, Portfolio)

Baillie Gifford (Trades, Portfolios) has over a century of experience and proven excellence in investment management. The company prioritizes the interests of existing customers and often closes products to new business to maintain strategic alignment and service quality. Baillie Gifford (Trades, Portfolios) manages assets for some of the world's largest professional investors, including pension funds and financial institutions from various continents. The firm's investment philosophy is rooted in fundamental analysis and proprietary research, with a focus on long-term, bottom-up investing. Baillie Gifford (Trade, Portfolio) seeks to identify companies with the potential for sustainable, above-average growth, typically over a period of five years or more.

Company profile of The Trade Desk Co., Ltd.

The Trade Desk Inc operates a self-service platform that revolutionizes the way advertisers and agencies buy digital advertising inventory across devices. Since his IPO in 2016, the company has shown impressive financial performance with an average annual revenue growth rate of 43%. The Trade Desk remains profitable with operating margins ranging from 10% to 28%. The company's demand-side platform is a major player in the digital advertising industry, generating revenue from ad spend fees.

Analyzing the trades of Baillie Gifford (Trades, Portfolio)

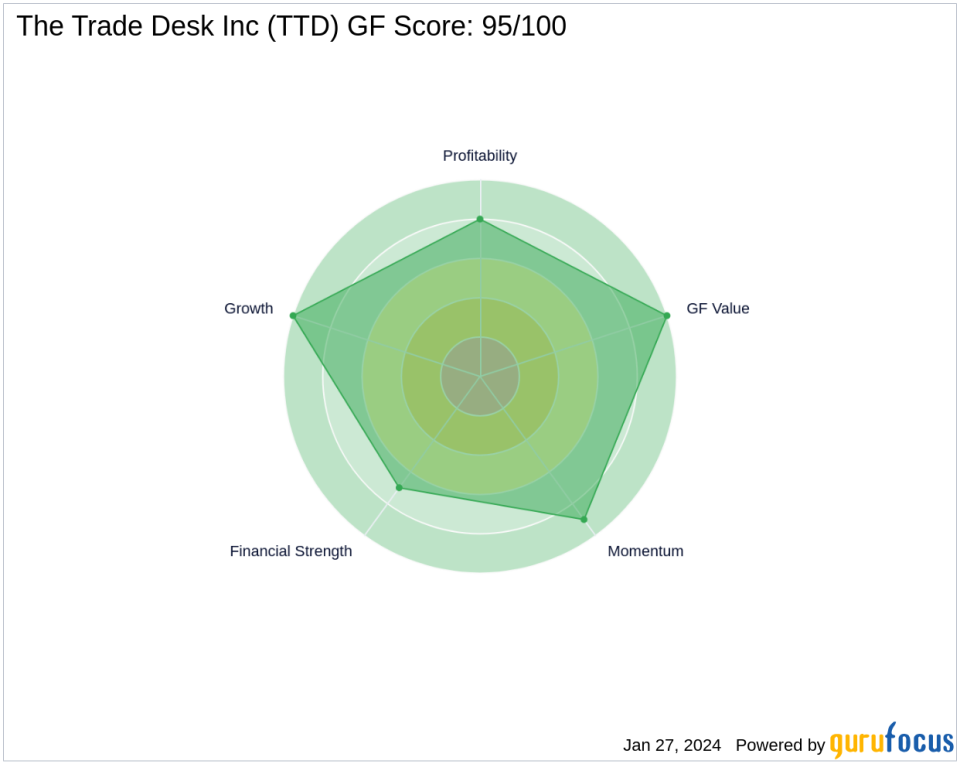

Baillie Gifford (Trades, Portfolio)'s sale price of TTD stock at $71.6 is higher than the current market price of $67.98, making it a timely decision given the stock price has since declined by -5.06%. is showing. The Trade Desk currently considers GF Value to be “significantly undervalued” at $98.86, suggesting upside potential. Although this transaction slightly reduced Baillie Gifford's (Trades, Portfolio) exposure to his TTD, the company remains a significant shareholder with a 9.18% stake in the company.

The Trade Desk Market Performance and Ratings

The Trade Desk boasts a market capitalization of $33.33 billion and a high P/E ratio of 219.29, reflecting its growth potential and market confidence. The company's GF Score of 98/100, found through GF-Score, indicates that it is likely to outperform the market. Trade Desk also ranks highly in Financial Strength (8/10), Profitability Rank (9/10), Growth Rank (10/10), GF Value Rank (10/10), and Momentum Rank (9/10). I am.

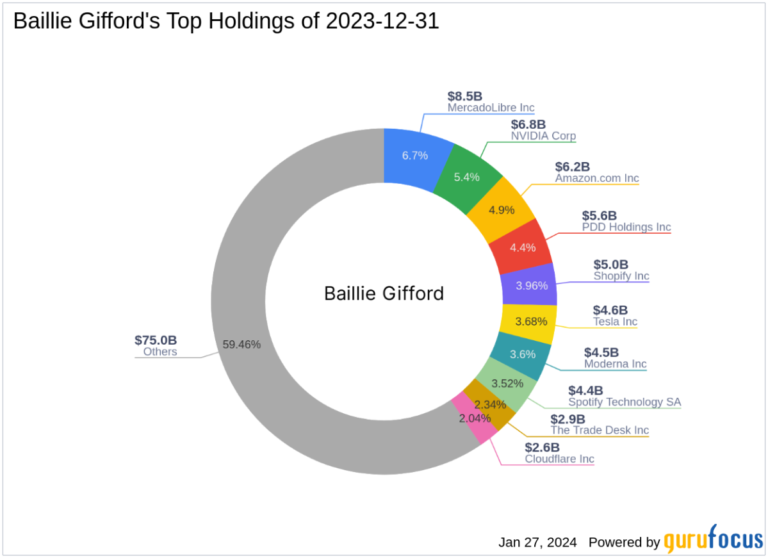

Baillie Gifford's hot sectors and major holdings (trades, portfolio)

Baillie Gifford (Trades, Portfolio)'s portfolio is focused on technology and consumer cyclical sectors, reflecting a focus on innovation and market trends. The company's major holdings include industry giants such as Amazon.com (NASDAQ:AMZN) and Nvidia (NASDAQ:NVDA), which support the company's strategy of investing in companies with high growth potential. is showing.

Other notable investors at The Trade Desk

Baron Funds holds the largest stake in The Trade Desk, and other notable investors include Jefferies Group (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio). Each investor's strategy and share percentage is different, providing diverse insights into the attractiveness of TTD investments.

Market situation and future outlook

Trade Desk operates in the competitive software space and has a strong position in the industry. Looking ahead, the company faces both growth opportunities and challenges. Baillie Gifford (Trades, Portfolio)'s recent trades reflect a strategic adjustment in its investment approach that balances long-term growth prospects with portfolio management considerations.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.