Key insights

- There will be opportunity to either reset for the future or accelerate growth in 2024.

- Health care consolidation will continue to be driven by margin pressure and labor woes.

- Artificial intelligence will be rapidly deployed throughout the industry.

- Capitol Hill will face political turbulence in 2024, with all issues being viewed through the lens of election year politics.

As we kick off 2024, there are various macro and micro trends of interest to the health care and life sciences sectors. Frequently, the trends intersect, reinforce, or cause one another — plus result in varying ripple effects across other parts of the industry.

With nearly 130 offices nationwide, a deep commitment to industry specialization, and a collaborative “team of teams” approach, we leverage our extensive experience serving thousands of health care and life science clients. Our ongoing commitment to the HCLS industry allows us to give the following perspectives.

Review some of the current trends impacting a cross-section of organizations and providers.

Continuing health care consolidation, deals

For any number of reasons, there’s ongoing consolidation and dealmaking in health care and life sciences. Labor expenses skyrocketed during the pandemic and then reset at higher rates. These higher labor rates and a tight labor market plus ongoing inflationary pressures are wreaking havoc on some operating margins. A ripple effect has resulted in closures or mergers and acquisitions.

Hospitals and health systems have weathered tough times post-pandemic, leading to divesting of underperforming hospitals, ceasing unprofitable services, or closing entirely. For some, regulatory scrutiny and due diligence led deals to fall apart.

For senior living, margin pressures and capital markets are major headwinds, which have also led to increased transactions or closures. While these pressures are felt across the country, rural providers are particularly vulnerable.

For physicians, the rising burden of insurance (think prior authorizations and medical record documentation), regulatory and compliance requirements, plus Medicare payment cuts are leading to a rise in affiliations or sales. Primary care practices have been seeking scale by aligning with hospitals and considering private equity and managed services organizations. Specialties like radiology, gastroenterology, dermatology, and medical aesthetics practices are attracting private equity attention.

Similarly, the cost to run a dental practice is rising and newer dentists have been less keen on buying into existing practices. Private equity interest is piqued, and dental service organizations are becoming more attractive.

In life sciences, after several years of hyper-valuations, those have normalized with deals becoming more deliberative and appropriately valued. There are some bright spots, such as the success of drugs like GLP-1s and the FDA’s approval of its first CRISPR drug to treat sickle cell, but other life sciences areas, such as digital therapeutics, have faced rougher waters.

We are also keeping our eyes on the payer side where some insurers are making significant market moves, becoming more vertically integrated than ever before through acquisition of provider practices, ambulatory surgical centers, post-acute care providers, and data analytics companies.

A ripple effect of all these transactions is a growing antitrust focus by key federal agencies — the Federal Trade Commission (FTC), Department of Health & Human Services, and the Justice Department. In late 2023, the tri-agencies finalized more robust merger guidance. The FTC’s interest in some mergers has already caused health care and biopharma deals to fall apart. There is also an interest by regulators in private equity’s role in consolidation.

Expect to see transactions continue as health care and life sciences work to adjust or reset to the current market and economic landscape. Depending on the situation, deals will be for any number of reasons — to build scale, decrease losses, or grow or tap new markets.

Labor market challenges

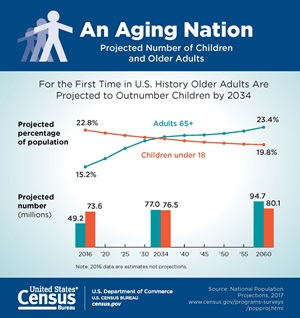

Labor woes have been and are expected to be an ongoing issue. A very tight labor market has loosened a bit and employment has stabilized over the past year. That said, wages have reset at higher rates. This places enormous financial and operational pressure on employers. Key roles in health care (physicians, nurses) are still experiencing high levels of burnout, leading to job changes, reduced hours, retirements, and an uptick in union activity. Demographics will complicate this picture as millions of eligible beneficiaries move into Medicare in the coming years. This will have ripple effects felt throughout all of health care and life sciences.

On the employment side, according to the U.S. Bureau of Labor Statistics, employment rates are relatively stable with the national unemployment rate at 3.7%, just 0.2% higher than a year ago. The labor force participation rate is close to pre-pandemic. Health care continues to see job growth but that is stabilizing. Certain states are seeing higher levels of job growth overall, such as Texas, California, Florida, Nevada, Idaho, and South Dakota.

Labor will likely reset and stabilize, but for some, it may not return to pre-pandemic levels. Out of necessity, we expect employers to continue innovating around positions and roles — more flexibility in job positions, creativity around roles, creating better career ladders, developing ways to “grow your own,” widening hiring pipelines, using artificial intelligence for efficiencies (see the “AI trend” later in this article), outsourcing and even right-sizing workforce levels. Some approaches may have immediate impacts while many are longer-term strategies.

Margin compression reveals vulnerabilities

Higher labor costs compounded by overall high operating costs due to inflation and economic uncertainly has created significant margin pressures. For many, higher reimbursement rates have not materialized to accommodate those higher operating expenses. This is particularly true for providers dependent on government payers like Medicaid. With an aging population, demographics will skew the financial picture toward Medicaid and Medicare. Rural providers are particularly vulnerable here. Commercial contract negotiations are getting tougher, and across all of health care, administrative expenses for compliance and paperwork are leading to growing frustration and inefficiencies.

Skilled nursing facilities (SNFs) in particular will have a tougher year. Made up almost exclusively of Medicare or Medicaid patients, many have very little wiggle room to make up operating expense increases. Further complicating this picture is a federal Medicare nurse staffing mandate expected later this year. According to our report on the proposed staffing mandate, the cost to hire enough staff to meet minimum staffing levels approaches $7 billion.

Hospitals and health systems are also facing difficulty this year. Ongoing mergers and acquisitions, joint ventures, or other strategic partnerships will be necessary as many seek to regain financial footing.

Others will face similar issues but perhaps not to the extent of hospitals and SNFs. For physicians, there is ongoing consternation around Medicare payment cuts with the profession urging Congress to act this year on a fix. Home health is also pushing Congress to address the “behavioral offset” reduction they are seeing. Hospices are facing increased regulatory scrutiny. Dental offices are facing higher expenses and reimbursement pressures, and the list goes on.

Across the industry, expect efforts to reduce inefficiencies, including use of artificial intelligence, as well as reassessing how and where care is delivered. Contract negotiations will likely be fierce, and you can expect entities to address debt covenants and liquidity.

Capitol Hill and election year impacts

This will be a rough year on Capitol Hill. There are small majorities in both chambers, which always makes passing bills more difficult, compounded by competing issues. It’s also an election year, which means all issues are viewed through that lens. The number one issue to address is funding government, which is magnified by a growing annual deficit and national debt.

A major tax bill — the Tax Relief for American Families and Workers Act of 2024 — passed by the U.S. House of Representatives is facing some difficulties in the U.S. Senate. The bill addresses business tax policies and the child tax credit. There are a variety of other issues that may be in play, such as reducing Medicare’s physician payment cuts, more price transparency, site neutral payments, enacting telehealth policies, reining in pharmacy benefit managers, and addressing drug prices. Whether any of those are enacted is touch and go.

On the regulatory side, there will be a robust agenda by the Department of Health & Human Services (HHS) as well as the FTC and Department of Labor. There is already substantial scrutiny of health care deals as seen in the recent release of revised tri-agency “merger guidance” and attention to private equity in health care. For drug companies, a major issue will be Medicare’s drug pricing negotiations.

Expect the dynamics on Capitol Hill to complicate passage of anything. But with tight majorities, anything can happen during negotiations. The Administration will likely push hard on its regulatory priorities, especially during the first half of the year.

Artificial intelligence may bring needed relief

Artificial intelligence (AI) might be one of the bright lights in the coming year for its potential to reduce inefficiencies, streamline processes, and reduce employee burnout. Long-term, it could revolutionize drug discoveries and care delivery.

Throughout the industry, AI is rapidly being deployed. It’s being used for medical scribes, revenue cycle applications, patient information, data analytics/predictive analytics, and much more. Because there isn’t a statutory or legal construct specific to AI, the landscape is wide open for a host of lawsuits (copyright infringement, patient rights, privacy violations, and more). Those creating and adopting AI must also work to protect against inherent bias of its outputs and address cybersecurity risks.

As you can imagine, heightened use of and attention to AI will likely occur across all of health care and life sciences. Regulatory and legislative attention to establishing guardrails for AI will spill in 2025 and beyond.

Rising role of Medicare Advantage

Medicare Advantage’s (MA) rise continues. It now comprises over half of all Medicare eligibles, or approximately 32 million people. The federal government has stated it wants all Medicare beneficiaries in an accountable care relationship by 2030. If MA as managed care is considered an accountable relationship, they’re well over halfway there.

As growth increases so, too, does attention. This has led to more regulatory and legislative attention and growing contract fights between providers and insurers over inadequate reimbursements and administrative burden. Even though there is strong support for the program, regulators are not letting them off the hook, changing Medicare Star ratings and auditing coding practices and risk adjustment.

Due to its popularity, size, and demographic trends, providers must pay attention to MA long-term. The program is where many patients will be consuming their health care dollars. Many existing Medicare value-based models have looked to use MA’s risk adjustment and financing methodologies.

Expect ongoing interest in MA, and expect regulators to continue scrutinizing MA cost and burden compared to traditional fee-for-service Medicare. Contract negotiations will likely be tough.

What you can do

For many health care and life science companies, we see 2024 as a year to regain footing and reset. For others, it may to put your foot on the growth pedal. Regardless, 2024 is the year to place your stake in the ground, find your financial and operational sweet spot, and chart your course forward.

What this may look like will vary by organization or individual:

- If you are facing financial difficulties, a financial or operational assessment may help you see service line profitability or practice management changes that are needed. 2024 may be a time to review your debt, financial viability, and strategic plan. It may also be the time to consider whether a merger or acquisition is in your future.

- If you are doing well financially, you may be looking to uncover new geographies or services. You may want to review value-based models as emerging opportunities for growth.

- If you are facing labor woes, leveraging the power of AI to reduce workforce and process inefficiencies may be a first step. Outsourcing or co-sourcing roles may be another viable option.

- Understanding the increasing role AI will play in the industry and your organization is crucial. A professional digital and data analytics team can help you develop your strategy and uncover new ways to understand and leverage your data, plus guard against the heightened potential for cyberattacks.

How we can help

CLA works closely with life sciences and providers across the entire health care continuum, which enables us to help you with the financial and operational challenges of today and the strategic challenges of the future. Our industry professionals can help you navigate 2024 by:

Contact us

Meet 2024’s financial and operational challenges head on. Complete the form below to connect with CLA.