with Nasdaq Composite With stock indexes soaring nearly 60% from their bear market lows, finding affordable tech stocks has become increasingly difficult. But by focusing on fast-growing companies operating in markets with decades of tailwinds, investors can find a small number of blue-chip stocks with reasonable valuations.

cloud strike (NASDAQ:CRWD) and clear secure (New York Stock Exchange: You) are two companies that meet this requirement, with sales increasing by 36% and 40%, respectively, in 2023. Both companies are working in the cybersecurity field. CrowdStrike's platform reduces the number of vendors needed to protect businesses from threats, and Clear Secure's biometric ID solution makes managing security checkpoints easier.

Here's how to buy these two supercharged tech stocks today.

CrowdStrike: Cybersecurity Integrator

CrowdStrike's Falcon platform, powered by artificial intelligence (AI) and machine learning (ML), provides customers with over 20 modules – unique cybersecurity offerings. CrowdStrike's numerous modules covering areas such as cloud and endpoint security, threat exposure management, and information technology (IT) automation make it an excellent choice for vendor integration.

Recent research by research companies gartner We found that 75% of companies are consolidating the number of cybersecurity vendors they work with. This makes CrowdStrike's wide range of services even more valuable. In fact, 64% of the company's customers are already using 5 or more modules, and 27% are using his 7 or more, highlighting CrowdStrike's integration capabilities. With most clients adopting many modules, the company's 580 customers spend more than $1 million annually across the platform, increasing by 33% in 2023.

This long list of customers gives the company a huge amount of data to feed back into its AI-powered threat graph. By filtering over 1 trillion data points every day, the company grows stronger with each new customer added and each new module purchased. Each additional customer or module strengthens your network, making your service more attractive to potential customers and creating a virtuous cycle.

This burgeoning network effect has helped CrowdStrike increase its revenue 12x since its initial public offering in 2019, while simultaneously increasing its stock price by more than 400%.

This would give the young cybersecurity company a seemingly hefty market cap of around $78 billion at recent prices. But this market capitalization is comically undervalued by 2034, as consulting firm McKinsey predicts the cybersecurity industry will grow from $150 billion today to $1.5 trillion to $2 trillion over the long term. It may turn out to be.

Gartner and forester, CrowdStrike is well-positioned to remain the most important disruptor in the cybersecurity space. This leadership reputation, coupled with the company's ever-growing module fleet, ever-expanding network, and impressive ability to generate free cash flow (roughly one-third of last year's revenue), makes CrowdStrike a buy and add today. It has become the tech stock of choice. As time goes by.

Clear Secure: High growth, deep cash, and low valuation

While CrowdStrike aims to serve as many customers in as many cybersecurity areas as possible, Clear Secure has one main focus: identity verification. Clear Secure is best known for its 147 Clear Plus members-only priority lanes at 56 airports across the U.S., which use biometric ID verification to help members get through security checkpoints faster. .

For $189 per year, customers can access these priority lanes by uploading their driver's license or passport to the Clear mobile app or airport kiosk. This time-saving and stress-reducing solution has proven easy for frequent users, and Clear Secure now has 6.7 million paid members, growing by 31% in 2023 .

In addition to these members, the company counts 13 million free members who use the Clear app to obtain flight details such as gate number and estimated walk time to the terminal. This “Home to Gate” feature is fully integrated with the company's free Reserve solution, which allows members to reserve a time to go through security (although they don't get priority access like Clear Plus members do). you can't).

Even more exciting for investors is that the company has ambitions to expand its identity verification capabilities to new channels. The company has partnered with companies in professional sports leagues, e-commerce, retail, financial services, hospitality, and healthcare through its business-to-business product, Clear Verified. One of our big success stories in this new growth area is our partnership with LinkedIn. Members could verify their identity for free through Clear Secure and receive an indicator of their verification on the site.

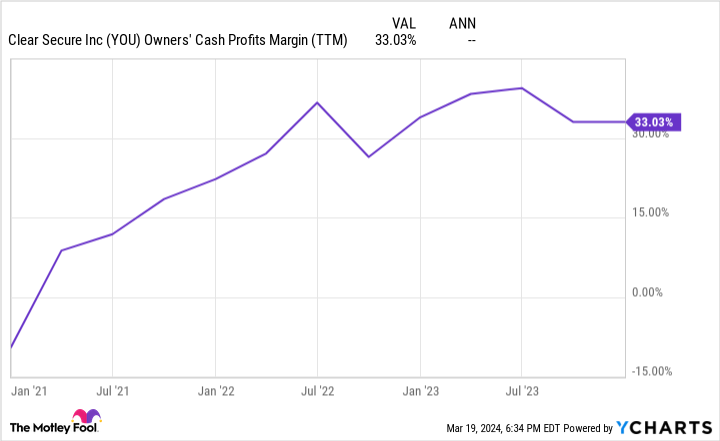

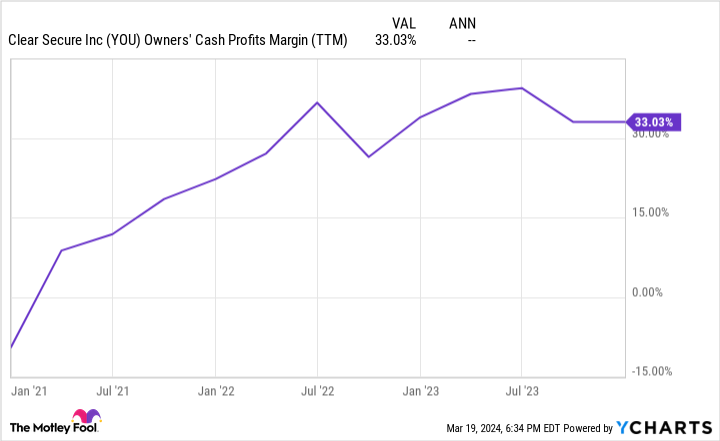

With this increase in use cases, it may not be surprising to learn that Clear Secure's revenue grew by 40% in 2023. While this growth is exciting in itself, it's likely been outweighed by the company's ballooning free cash flow margins. 33%.

And these results shouldn't be a one-time feat. In fact, management says this free cash flow, combined with ClearSecure's sales, should increase by more than 30% in 2024.

What is the most important thing for investors? Despite this shift to strong cash generation, the company trades at a cheap valuation of just 9x FCF.

Armed with more than $700 million in cash and marketable securities, no debt, and near $200 million in FCF in 2023, management is looking to take advantage of today's low valuations by selling its own stock. Increased purchase authorization to $128 million. In addition to these share buybacks, this cash reserve should easily fund dividend increases, which yields about 1.3% at recent prices. Especially since his only 16% of Clear Secure's annual FCF was used for these dividends.

This combination of high sales growth, strong FCF generation, generous cash returns to shareholders, and a cheap valuation makes Clear Secure a great tech stock to buy without hesitation.

Should you invest $1,000 in CrowdStrike now?

Before purchasing stocks on CrowdStrike, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Things investors can buy right now…and CrowdStrike wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 21, 2024

Josh Kohn-Lindquist is with Clear Secure and CrowdStrike. The Motley Fool has a position in and recommends Clear Secure and CrowdStrike. The Motley Fool recommends his Gartner. The Motley Fool has a disclosure policy.

2 supercharged tech stocks to buy without hesitation was originally published by The Motley Fool