If you're a dividend investor like me, you value consistency in all market environments, whether bullish or bearish. High yields backed by declining dividends are likely to lead to lower income and loss of capital. no thanks! For this reason, one of the first screens I use when searching for a stock is a company's dividend increase history. Next, we look at the business behind the dividend. enbridge (NYSE:ENB) and NextEra Energy (NYSE:Nee) Both look like stocks that dividend investors will want to own for the long term.

Enbridge is a slow and steady turtle

Canada's Enbridge is grouped together in the midstream energy sector. This is a good position considering that about 57% of the company's earnings before interest, taxes, depreciation, and amortization (EBITDA) comes from oil pipelines and an additional 28% from natural gas pipelines. In fact, the company is one of the largest midstream companies in North America, with a portfolio of energy infrastructure that is difficult, if not impossible, to replace or replicate.

The pipelines and other midstream assets the company owns are primarily fee-funded, resulting in fairly consistent cash flows regardless of what's happening with energy prices. But just do the math. This aspect of the company accounts for his 85% of his EBITDA. The remainder comes from regulated natural gas operations (12% of EBITDA) and renewable power assets (remaining). Regulated electric utilities are very boring and unreliable cash flow generators, and the renewable power assets owned by Enbridge are based on long-term contracts.

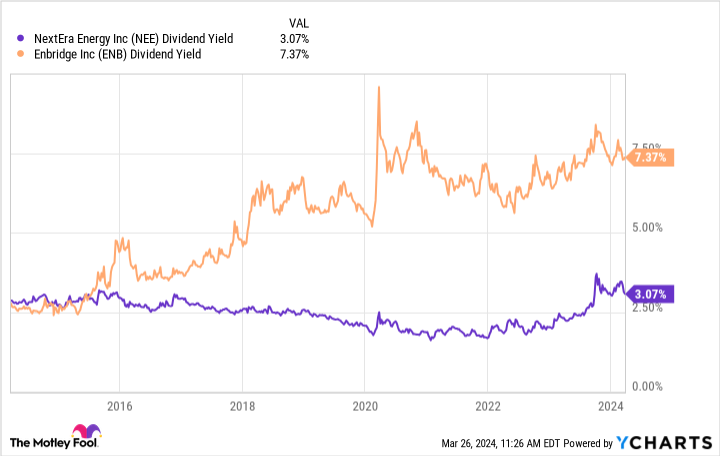

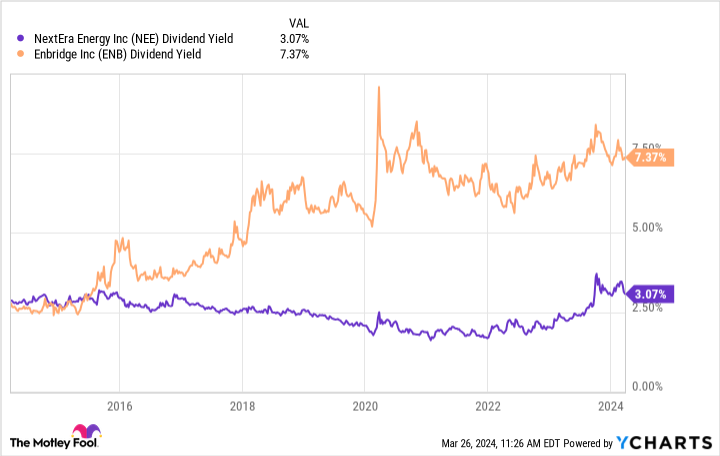

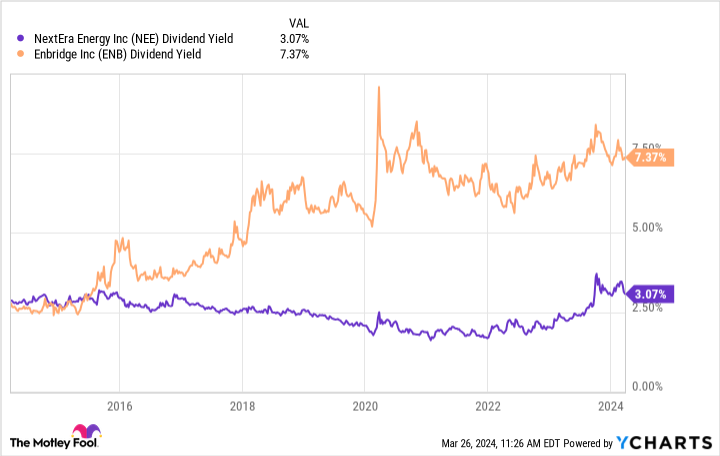

Enough cash flow is flowing in to cover the historically high 7.5% dividend yield, and the distributable cash flow payout ratio is comfortably in the middle of the company's target range of 60% to 70%. It is noteworthy that Meanwhile, the dividend has increased every year for 29 consecutive years. There are no signs that the dividend streak is nearing an end.

But Enbridge is about to become even more boring and reliable, with plans to acquire three additional regulated natural gas companies in 2024. As a result, the business composition will be 50% oil pipes, 25% gas pipes, 22% gas business, and 3% clean energy. Paying a conservative and stable dividend is clearly a priority for management. High yields are likely to make up the bulk of the total return here, but that should be a plus for investors looking to maximize the returns they generate from their portfolios.

NextEra is a great choice for dividend growth investors

Not everyone is looking for high-yield stocks. Some people prefer to own companies that reward income investors with rapid dividend growth. That's exactly what you get with NextEra Energy, one of the largest electric utilities in the United States. A utility with high dividend growth may sound too good to be true, but NextEra Energy's dividend has increased by 10% per year over the past decade. That's pretty good for any company, but even better for a utility. In fact, half the dividend growth rate is a strong number for a utility company.

Even better, NextEra Energy's management predicts dividend growth of around 10% per year through 2026. Therefore, on the back of earnings growth of 6% to 8% per year, we expect even more significant dividend increases. By the way, the company has increased its dividend for 29 consecutive years, and the current dividend yield is approximately 3.3%, a historically high level. The 3.3% yield won't excite income-focused investors, but when combined with a solid dividend growth rate, NextEra Energy should be very attractive for dividend growth or growth and income investors.

The key to the growth story here is that NextEra Energy is actually combining a slow-and-steady regulated power business with a fast-growing renewable power business. The clean energy transition that is taking shape is decades in the making, so there's no reason to believe that NextEra Energy's growth runway will come to an abrupt halt anytime soon.

Choose between high yield or high growth

Enbridge and NextEra Energy likely appeal to different types of investors. However, they share some very important characteristics. Both have impressive dividend histories, strong, reliable businesses, and historically high yields. These are the types of dividend stocks you buy and hold for the long term, especially if you buy when it looks like there's a sell-off.

Should you invest $1,000 in Enbridge right now?

Before buying Enbridge stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Investors can buy now…and Enbridge wasn't one of them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 25, 2024

Reuben Greg Brewer holds a position at Enbridge. The Motley Fool has positions in and recommends Enbridge and NextEra Energy. The Motley Fool has a disclosure policy.

Bull Market Buys: 2 Dividend Stocks to Own for the Long Run was originally published by The Motley Fool.