Here are the takeaways from today's Morning Brief. sign up Every morning you will receive the following message in your inbox:

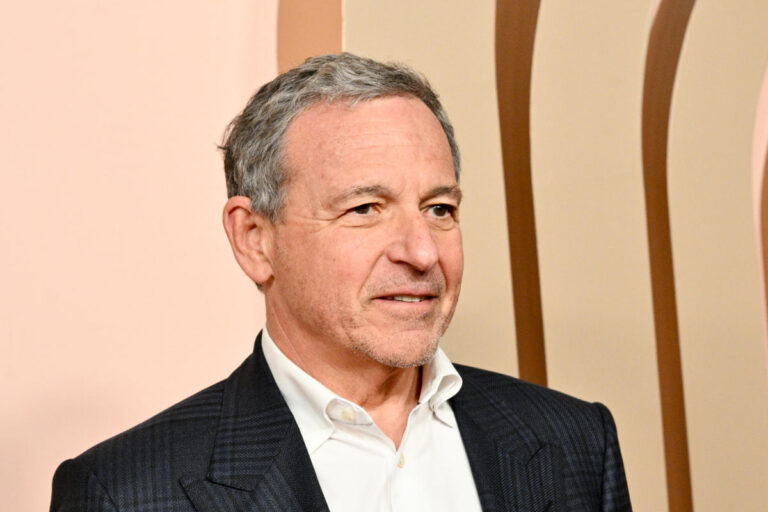

Bog Eiger is in great shape.

A week after resolving a “win-win” situation with the state of Florida, Mr. Iger has won a painful proxy battle. This marks two significant wins for him and clears up a major turmoil that has plagued Disney over the past year.

But now that it has cleared the way and quieted the company's outside critics, all the problems at home still remain.

Traditional media giants straddle two worlds. The old and profitable system of cable TV is on the decline as many customers say goodbye to traditional bundles. But the new streaming model is not a savior. And there is no profit yet.

The future of ESPN, an iconic brand in sports entertainment, is also up in the air. Management is pursuing a strategy of direct-to-consumer services and joint ventures to reshape the way fans watch sports and recapture high prices similar to cable subscriptions.

Another challenge for Disney is what happens to its $60 billion investment in theme parks and resorts.

The same goes for regaining box office dominance.

Disney's moment of uncertainty extends to Iger himself and the role of CEO. Even if he could right the ship, who would succeed him? And how will the board avoid making another unfortunate choice after Bob Chapek's brief and difficult turn?

While Mr. Iger is campaigning to fend off activist challenges, shareholders said he has expressed the importance of Disney having a succession plan in place. And as Yahoo Finance's Allie Canal reports, selecting the next CEO is a top priority for the board. Iger's contract is scheduled to expire at the end of 2026.

Disney stock has risen nearly 50% since falling to multi-year lows in October. Meanwhile, Iger and his management team have undertaken a series of ambitious initiatives to revitalize the company, including reorganizing its film studio and partnering with Epic Games, the maker of “Fortnite.”

Mr. Iger denies claims that Mr. Peltz's activist campaign instigated the recent changes that the market has celebrated. If anything, he said in an interview with CNBC on Thursday, the proxy fight is a distraction and dilutes the time he has to spend on his restructuring plan.

“The market was reacting to this company's performance, but it wasn't really reacting to the fight against the activist,” he said.

That may be true. But for now, the uncertainty about whether management strategy or insurgent threats were driving Disney's performance will dissipate.

Without any outside spoilers, all that remains is Eiger's show-me story.

Hamza Shaban is a reporter for Yahoo Finance, covering markets and economics. Follow Hamza on Twitter @hshaban.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance