As the annual tax filing deadline approaches, another important deadline appears to have passed unnoticed by some San Francisco officials. A total of 463 government employees have failed to disclose their income, gifts, and assets as required by state law.

Thirty-five percent of those unreported are public health appointees and employees, with 162 missing, followed by school districts and transportation departments.

As of April 9, four directors of the National General Debt Oversight Committee (which has about six members at a time to oversee the allocation of the national debt) had not filed a notification. This means that the committee responsible for auditing government spending is not auditing itself.

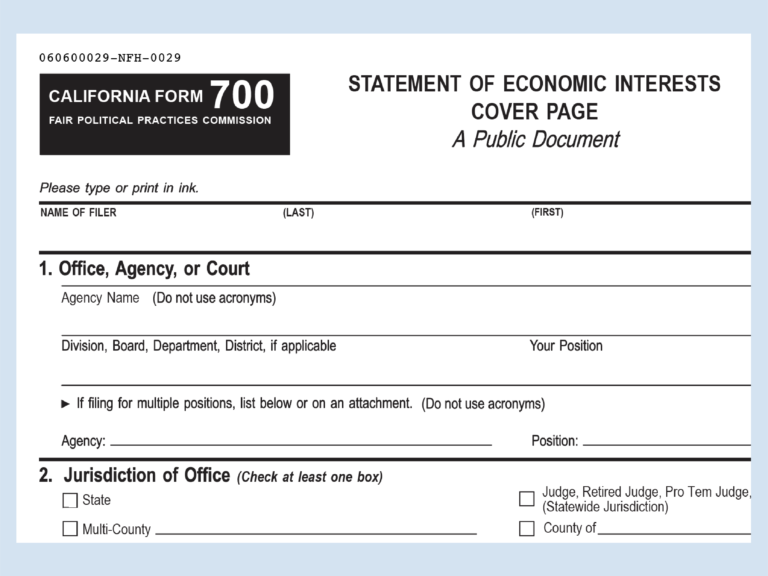

The “Statement of Economic Interests” or Form 700 exists to prevent conflicts of interest in government decision-making. Approximately 5,942 city employees who make decisions or provide information to city officials will be required to declare whether they have financial interests that could affect their work.

Michael Canning, policy and legislative affairs manager for the San Francisco Ethics Commission, said, “Forcing city officials to disclose their financial interests ensures that government decisions are in the best interest of the public, not the public interest of city officials.” I can guarantee that it will be prioritized.” .

If they don't, “this important transparency tool will be lost and the public will be denied the information they are entitled to,” Canning added.

The deadline was April 2, 2024. To provide “a different kind of transparency in this situation,” Canning said, the Ethics Commission listed all the people who had not disclosed their assets on their websites.

The offenders included 24 commissioners and board members, as well as high-ranking city officials, including numerous deputy directors from various departments, including the assistant medical examiner and deputy director of the Department of Homelessness and Housing Services. ing.

Commissioners and board members are disqualified from attending meetings or making decisions until they disclose their financial assets. All delinquent filers will be subject to a penalty of $5,000 or up to three times the cumulative amount not filed.