If you want to compound your wealth in the stock market, you can do so by purchasing index funds. But you can do better than that by choosing stocks that are better than the average (as part of a diversified portfolio). In other words, Kosan Rubber Industries Co., Ltd. (KLSE:KOSSAN)'s share price is up 57% from a year ago, far better than the market return of around 9.7% (not including dividends) over the same period. If it can sustain that outperformance over time, investors will do very well.If you zoom out, the stock price is actually under 42% in the last three years.

It's been a good week for Kosan Rubber Industries Ltd. shareholders, so let's take a look at the long-term fundamental trend.

Check out our latest analysis for Kosan Rubber Industries Co., Ltd.

In Buffett's words, “Ships will sail around the world, but a flat-Earth society will thrive.'' There will continue to be a wide discrepancy between prices and values in the marketplace. ..' One imperfect but simple way to consider how the market perception of a company has changed is to compare the change in the earnings per share (EPS) with the share price. price movement.

Kosan Rubber Industries turned from a deficit to a profit last year.

If a company is on the edge of profitability, it may be well worth considering other metrics to more accurately measure growth (and thus understand share price movement).

I don't think the modest dividend yield of 0.9% is supporting the stock price. Unfortunately, Kosan Rubber Industries Co., Ltd. was down 32% in his twelve months. Therefore, fundamental indicators do not provide a clear explanation for stock price increases.

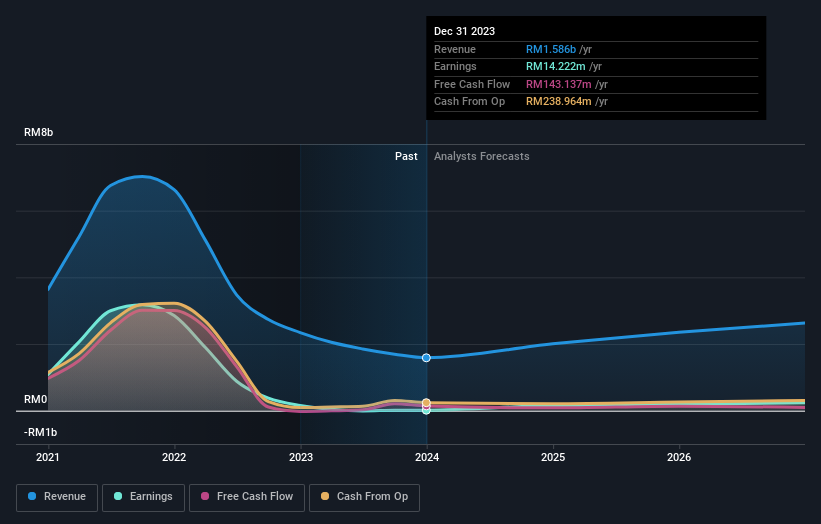

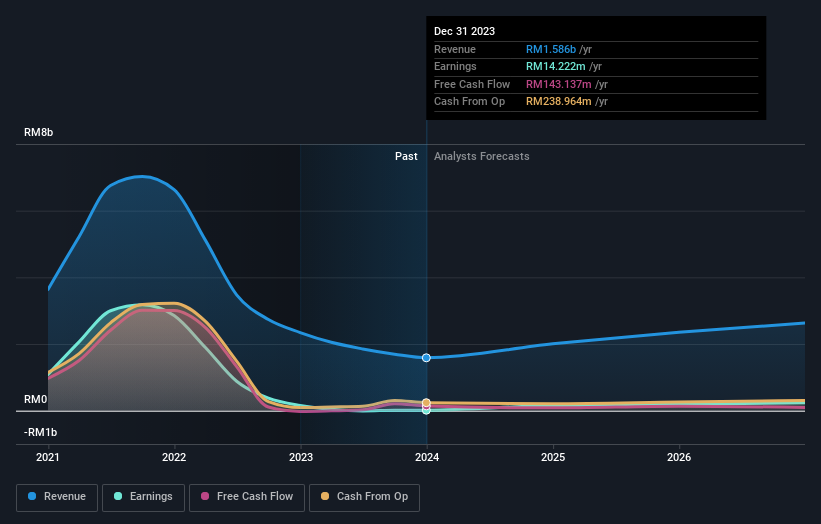

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Kossan Rubber Industries, Inc. is a well-known stock that is covered by many analysts, suggesting some expectation for its future growth. Find out what analysts are predicting for Kosan Rubber Industries Co., Ltd. in this article. interaction Graph of future profit forecast.

different perspective

It's good to see that Kosan Rubber Industries Ltd. shareholders received a total shareholder return of 59% over the last year. That includes dividends. This is better than the 10% annualized return over the past five years, suggesting that the company has performed well of late. In the best-case scenario, this could signal real business momentum and suggest that now could be a great time to dig deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Nevertheless, please note that Kosan Rubber Industries Co., Ltd. indicates that: 2 warning signs in investment analysis you should know…

However, please note: Kosan Rubber Industries Co., Ltd. may not be the best stock to buy..So take a look at this free A list of interesting companies that have grown their earnings in the past (and are predicted to grow in the future).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.