Here are the takeaways from today's Morning Brief. sign up Every morning you will receive the following message in your inbox:

Maybe I'm going to tell you something here that you already know, but it would be repetitive.

I do not believe that the majority of public company boards, executives, investor relations departments, and other relevant teams are generally indifferent about individual investors. AKA the average investor, AKA Main Street, AKA the person who works hard every day in hopes of living comfortably in retirement.

You're probably reading this article this Sunday morning, drinking your homemade coffee and wondering if you should add 25 more stocks priced under $5. Or one stock of Nvidia (NVDA).

How can we make such a bold declaration?

First of all, I talk to all these groups of people every waking hour, and I've been doing that for 21 years. Everyone knows about their compensation plan, their job perks, what institutional investors are doing, what their competitors are saying on TV, and how influential sell-side analysts are lowering their forecasts and lowering their ratings. I'm very attached to what I'm doing and what I'm doing.

Other concerns include the business plan and its execution, as well as the much-publicized succession decision for the deputy boss.

I never hear them discuss how their actions affect the average investor. And I mean never.

Then look at how companies speak to the outside world when they are forced to do so. This is still some form of Morse code and requires an honors degree from Harvard to decipher.

Please take 10 minutes today to read the transcript of Microsoft's (MSFT) latest earnings call. It is provided here for easy reference. Honestly, do you have any idea what they're saying and how that shapes the value of the 10 stocks you own? Probably not. I myself often get confused about the meaning of technical terms.

Good luck understanding all the abbreviations in Coca-Cola's (KO) infamously exhaustive earnings call. This is the company's last earnings report. How can a company that makes such a simple product (water with various sugars and dyes) produce such complex financial results?

I brought this all up in the wake of the Disney (DIS) vs. Nelson Peltz board fight.

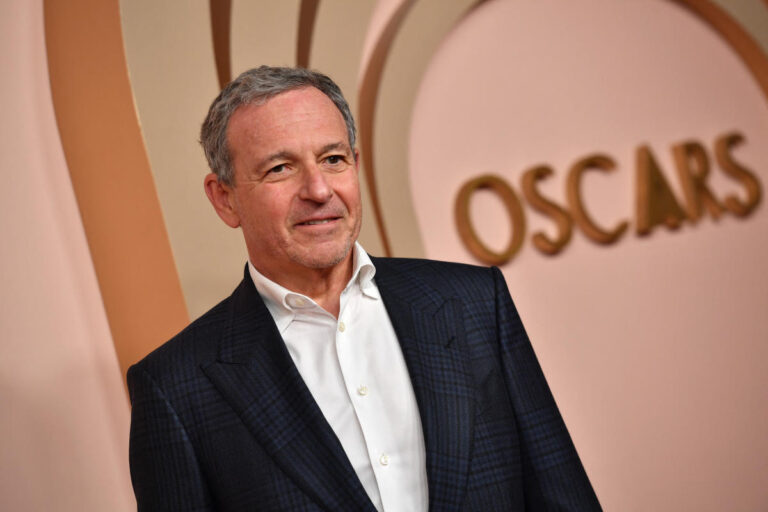

Throughout the ordeal, we heard Disney CEO Bob Iger fire back at billionaire Peltz. He heard Peltz fire back at Iger, a very healthy 73-year-old. We've seen both parties plead for support from institutional investors such as BlackRock and T. Rowe Price.

Neither person spoke directly to individual investors, perhaps because they believed they were denying their place on earth. Neither company followed Elon Musk's style and held webcasts to take questions from public shareholders.

Eiger could have done this. They are a media company and definitely have the assets to run (reach out, Bob, we can host these webcasts on Yahoo Finance).

After all, it was the individual investors who played a big role in the final outcome.

Individual investors make up just under 40% of Disney's shareholder base. The Wall Street Journal reported that about 75% of retail investors who voted supported Disney's intentions.

If Peltz had spoken directly to this group, he likely would have been placed on Disney's board. If Iger had appealed directly to this group, perhaps his victory would have been even greater – perhaps it would have given him another bragging moment at a movie premiere before he retires in 2026.

So now, my message to Mr. Iger is as follows. Mickey, the average investor who owns your stock because they like your movies and your dividend checks is rooting for you and what you want to do. They are a powerful group, so show them some respect. Please deliver for them.

Retail trading volume reached its highest level in 2023. From 2019 to 2022, direct ownership of stocks increased from 15% to 21%, the largest change on record, according to Federal Reserve data.

Meanwhile, the World Economic Forum predicts that retail investors will account for 61% of global assets under management by 2030, rising to 52% in 2021.

Steve Sosnick, chief strategist at Interactive Brokers, told me that retail investors are a force to be reckoned with.

“They do follow the action and are drawn to big names and strange situations that pop up,” Sosnick said.

He's right.

And Bob, you shouldn't be complacent either. Otherwise, this group will change direction, perhaps impacting larger investors than this current change in direction. Do it or else.

“Pressure on Bob Iger [until he retires in 2026] “Activists are surrounding this company, but the only way to keep them out is if the stock price continues to rise,” Needham analyst Laura Martin said on Yahoo Finance Live. Stated.

Disney declined to make Bob Iger available for an interview with Yahoo Finance.

Brian Sozzi I'm the executive editor of Yahoo Finance. Follow Sozzi on Twitter/X @BrianSozzi And even more linkedin. Have a tip about a deal, merger, activist situation, or more? Email brian.sozzi@yahoofinance.com.

For the latest stock market news and in-depth analysis of price-moving events, click here.

Read the latest financial and business news from Yahoo Finance