Image credits: Dheeraj Singh/Bloomberg/Getty Images

Amazon is stepping up its efforts to compete with Walmart-owned Flipkart and Reliance's Agio, which have penetrated deep into India's fast-fashion market. “special stores'' were secretly introduced into India.

The world's largest e-commerce company has rolled out a new store on its Android app in India. TechCrunch previously reported that Amazon began recruiting sellers for the new store in February, promising “hassle-free” shipping, zero referral fees, and access to its vast customer base.

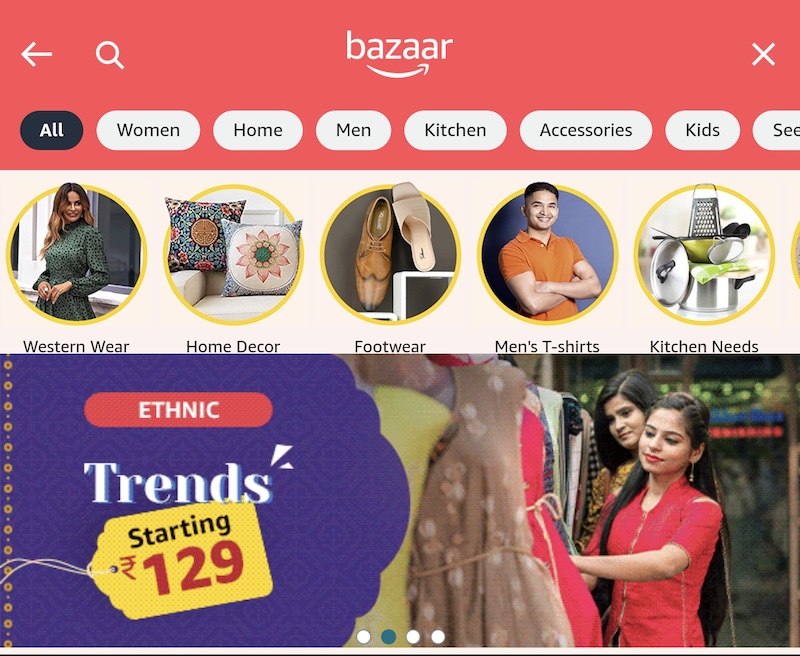

“You'll find a wide range of products, from clothing, accessories and jewelry to handbags, shoes, traditional and Western clothing, kitchenware, and a wide range of home goods such as towels, bed linen and decorative items,” the company says on its support page. writes.

The growing popularity of affordable fast fashion is driving more and more purchases on India's many shopping apps, giving Amazon strength in a category that has traditionally struggled in the country, according to brokerage Bernstein. Maintaining your position has become extremely important.

“The composition of e-commerce categories in India is changing. The share of mobile and consumer electronics has declined. Fashion has seen the strongest growth since FY19 and now holds the highest category share.” Bernstein analysts wrote in a note last month.

Bazaar's products include “trendy” T-shirts starting at INR 129 ($1.55) and sneakers under $3.

India is a key overseas market for Amazon, with the company investing more than $11 billion in the country to date. Even as the company's cloud arm, AWS, maintains its market-leading position in India, Amazon's e-commerce arm remains in second place behind Flipkart.

Last year, CEO Andy Jassy announced plans to invest $12.7 billion in AWS in India by 2030, as well as more than $2 billion in the e-commerce sector over the same period. Announced.

Screenshot of the Amazon India Android app. (Image: TechCrunch)

The fast fashion e-commerce market has received a lot of attention in India in recent years, with local startups drawing inspiration from global pioneers such as ZARA, H&M and Uniqlo. Bernstein said Flipkart (which owns fashion e-commerce platform Myntra) currently leads the space, but competition is increasing from Reliance's Ajio, which has gained about 30% market share in about a year. It is said that they are facing.

Agio launched its own fast fashion platform Agio Street last year, offering a wide selection of clothing and accessories at prices as low as INR 199 ($2.40). The platform guarantees the “lowest price” for products, waives shipping fees, and offers an easy returns process.

Shein, a global pioneer in the category that India had previously banned, said last year that it was preparing to return to India through a joint venture with Reliance, the country's most valuable company. The oil telecom major also operates Reliance Retail, the country's largest retail chain.