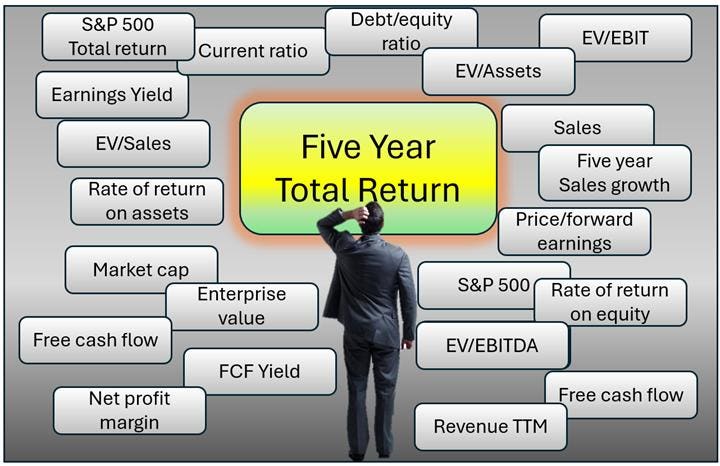

Figure 1: A man looks at multiple metrics to analyze company performance.

“Disney has won.” “The end of Amazon!” “BYD crushed Tesla!” “Big Tech is history!” So how can anyone understand the screaming headlines in the economic newspapers that often blow things completely out of proportion?

How do you know which companies are creating real value for their stakeholders over time and sustainably? Is there an easy way to decipher what's important amidst the noise? This issue is especially important at a time when a foretold paradigm shift in the way companies create value is underway. It is important to not only say that a company is creating value, but also to know to what extent it is actually creating value.

Although there are many analytical tools available, the five-year total return for publicly traded companies, as shown in Figure 1 above, is a simple and easy to understand and accessible way to see the underlying value performance and capabilities of individual companies. It is a possible tool. on its own terms and in relation to its peers or all listed companies. This helps form the basis for making inferences about future performance.

How Barron's Misjudged Pfizer's Value Creation Potential

Just yesterday, Barron's published an insightful article explaining the mistake it made exactly one year ago (February 5, 2023) when it published an article with the headline “Why Pfizer Stock is a Buy.” did. The predicted performance improvement never materialized.

A recent article in Baron magazine reveals that if you had paid attention to Pfizer's long-term returns (5, 10, and even 20 years), you would have noticed that Pfizer's value creation performance has been steadily below average over a long period of time. Deaf, he points out. It's a bonanza created by the coronavirus vaccine developed by his partner BioNTech. Therefore, it is highly unlikely that value creation will suddenly improve.

In contrast, anyone interested in pharmaceutical company value creation should have noticed that Eli Lilly and Novo Nordisk's five-year total returns have been steadily above average over the past five years. It didn't take any special insight to guess that they would continue to do so.

Figure 2: Five-year total return: S&P 500 vs. Pfizer, Eli Lilly, and Novo Nordisk.

5 total returns help reveal the big picture

You don't need any special knowledge or expertise to access a company's five-year total profit. This information is readily available for free on many sites, including Finance Charts.

Due to the complex and adaptive nature of organizations, it is impossible to scientifically determine causes or predict the future with or without experimentation, but the stock market is based on the past value of public companies. It provides us with a treasure trove of information about creation and consensus predictions. and speculation about the future. The stock market can be used for a variety of purposes, including short-term and long-term investments, gambling on variations, raising money, and promoting companies. More importantly, it can be used to objectively assess how much value a company is creating for its stakeholders.

Finding your way through the maze of data can be difficult. The 5-year total return can help you start your evaluation.

A company's five-year total return (as defined in Appendix 1 below) reflects the “wisdom of the crowd” about a company's profits; direction And that speed It is often the best starting point for making meaningful inferences about a company's value creation performance over a sustained period of time.

· The nature and causes of past performance.

· The expected rate of future value creation.

· Performance relative to peers, i.e. companies in the same sector.

· Performance for all listed companies.

· The relative performance of companies of different sizes.

Therefore, if a company's 5-year total return is higher than the 5-year total return of the S&P 500, it is an interim indication that the company is consistently creating value for its stakeholders at a faster pace than the average S&P company. conclusions can be reached. The number of items in stock during the period is 500 pieces.

This is the beginning of the analysis, not the final answer. There may be many other factors to consider, such as sector specificities, changes in management and personnel, anticipated competition, and economic disruption. But at least it provides a starting point for evaluating these factors.

Two-thirds of Dow companies are below average value creator.

Take the example of the Dow Jones Industrial Average, commonly known as the “Dow.” It includes 30 reputable “blue-chip” companies. These companies are internationally recognized, established, considered financially sound, and publicly traded companies.

Despite the Dow's well-known limitations as a measure of the overall stock market, it has become synonymous with the performance of the overall U.S. stock market in the public's mind. When people say the stock market has gone up or down, they are usually referring to changes in the Dow Jones Industrial Average.

It is little known to the general public that the performance of the 30 companies included in the Dow Jones Industrial Average varies significantly. While some companies have consistently performed well above average, two-thirds of the Dow Jones Industrial Average companies have consistently performed below average over the past five years. This means that these companies' five-year returns are lower than the average of all 500 S&P 500 companies. (Figure 2)

Therefore, the five-year total return shows that only 12 of the 30 Dow companies created value for their stakeholders faster than the average of all Dow stocks over the five-year period. S&P500.

Figure 3: Five-year total returns of companies included in the Dow Jones Industrial Average

On the other hand, the often-criticized big tech companies are above-average value creators. Overall, this situation is consistent with the hypothesis that a paradigm shift in management is underway.

5-year returns help put anecdotal explanations into context

Five-year total returns can also be used to supplement anecdotal accounts of value creation performance. For example, Professor Rita McGrath of Columbia Business School provides a brilliant anecdote about how Verizon's processes are systematically destroying customer value: “As automated customer service options improve, the customer service experience deteriorates.” provided to us. The table in Figure 3 shows that Verizon's value creation performance is very poor. Verizon is at the bottom. Verizon's performance compared to its peers can be seen more clearly in Figure 4. Worth a thousand words. ”

Figure 4: 5-Year Total Return: S&P500 vs. Verizon, AT&T, T-Mobil-US

Large fluctuations evident in the graphical depiction

A graph of five-year total returns provides other insights as well. Therefore, you can see how a company's total revenue is affected by the ups and downs of the overall economy. (See Figure 5) His five-year total returns for big tech companies like Microsoft and Amazon are all net positive compared to the S&P 500, even though they declined in 2021. In contrast, Verizon continued on a steady negative trajectory throughout his five years. -Duration of years.

Figure 5: 5-Year Total Return: S&P 500 vs. Microsoft, Amazon, Verizon

For a detailed discussion of the pros and cons of five-year total return as a tool for assessing value creation, and a discussion of alternatives, see Part 2 of this series in the following articles: “Assessing 5-Year Total Returns” as a Measure of Value Creation Performance. ”

Also read:

The management paradigm that powers the world's most valuable companies

How corporate purpose inspires the world's most valuable companies

Appendix 1

Figure 6: Technical Note: Defining Total Return

Appendix 2

Figure 7 Appendix 2: Most Valuable Japanese Companies in the US and Europe