hapa bapa

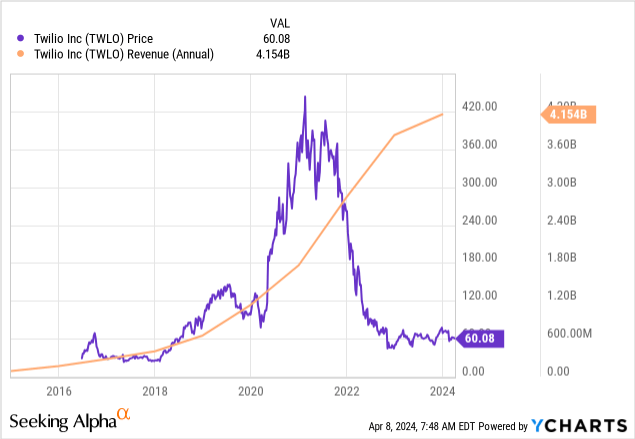

Twilio's (New York Stock Exchange:TWLO) Ratings have dropped significantly. One reason for this is that while the strategically important segment business, formerly known as his Twilio, is growing, growth is slowing, as shown in the graph below. The Data & Applications segment continues to experience poor performance.

Since August last year, the company's foray into artificial intelligence using customer AI has not contributed to the stock price.

Against this backdrop, the purpose of this purchase thesis is to demonstrate that a review of the operations of the segment business could unlock value and also make progress on cash generation. First, we provide an overview of the challenges faced to reflect the market view.

Competition and the challenge of growth

Twilio is a cloud communications company that specializes in APIs (Application Program Interfaces) or software code that enable the transmission of data between different providers.just Think about the people who subscribe to AT&T (T) Send a text message to a friend using Verizon (VZ) mobile plan and use WhatsApp, both owned by Meta Platforms (Meta). In addition to connecting your corporate website to numerous other mobile apps, APIs are key to delivering messages end-to-end.

To enable such feats, Twilio has a customer engagement platform that is accessed by over 10 million developers worldwide. Here, prioritizing developer relationships and providing cross-network interoperability while focusing on data-driven customer engagement contributed to success.

www.twilio.com

But in an industry with relatively low barriers to entry, other companies are rapidly building cloud-based communications platforms, including Bandwidth (BAND), MessageBird, Sinch, and Ericsson (ERIC). And don't forget about Vonage. In this regard, Ericsson, already a leading telecommunications wireless equipment manufacturer, completed the acquisition of Vonage in 2022 to enter the CPaaS (communications platform as a service) world.

Therefore, despite its technological prowess in CPaaS, competitive pressures are limiting Twilio's ability to increase its pricing power and revenue as much as before. It is also affected by the seasonality of demand over the past two years. Looking ahead, revenue growth is expected to moderate as traffic stabilizes, with the analyst's forecast of 5.22% for FY2024 being lower than his 8.56% for the previous year. As a solution, Twilio turned to AI.

AI will have an impact, but probably not until 2025

Given the usage-based nature of the platform, one way to drive traffic is through the use of artificial intelligence. One advantage here is that, in addition to the API ecosystem, there is a wealth of data at hand that can be used to train AI algorithms. This allows customers to derive insights from their communications (using both text messages and voice calls). Therefore, since its launch in H2 2023, Customer AI Predictive Analytics has trained 150 companies to identify and recommend products that are most likely to be purchased to customers as part of cross-selling and inventory liquidation efforts. Used by more than 1,000 customers.

www.twilio.com

And Twilio Voice Intelligence, an AI-driven feature that analyzes everyday conversations between agents and the customers they speak to extract actionable business intelligence, has already processed more than 42 million minutes of calls. Still, as of the last earnings release date, it was available in a beta (test) version, meaning it was not monetized.

Notably, some of these developments revolve around traditional flavors of artificial intelligence or machine learning, which have found new life after the proliferation of ChatGPT. Additionally, the company has a deal with Google for advanced analytics, and in August last year he announced a major deal with OpenAI on GPT-4 to drive Gen AI capabilities for his 300,000 Twilio customers. We have entered into an advertised partnership.

However, no amount has been provided in the pipeline. Additionally, Gartner researchers say customers may generally take a wait-and-see approach this year following resource-intensive digital transformation trends since COVID-19. It becomes more sexual. Rather, amid uncertain macroeconomic conditions primarily caused by high inflation and rising interest rates, companies will only invest in Gen AI in 2025 after carefully planning their projects to maximize outcomes. Should.

Once this happens, AI voice recognition and speech recognition in contact centers should benefit. This market is projected to grow at a CAGR of 17.2% from 2018.m 2023 to 2028. Another positive is the review of the segment business, which is CDP (customer data platform).

Problematic segment business

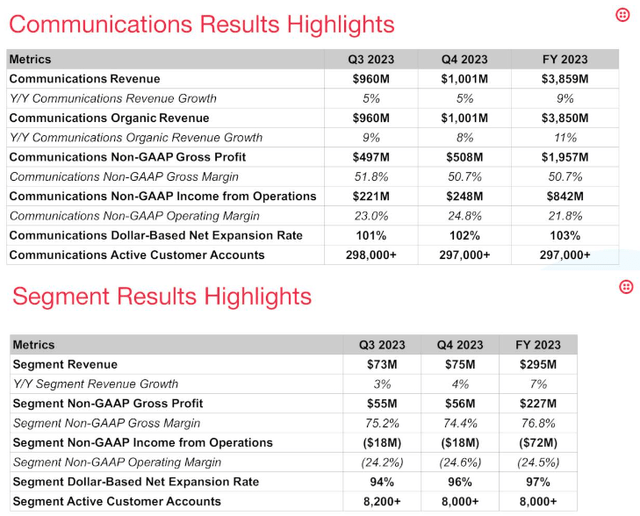

First, the company's business is currently centered around two businesses: Telecommunications and Segment, the latter of which generated only 7.1% of its FY23 revenue, the results of which are highlighted below. Additionally, segment businesses suffered from slower growth.

Financial results call presentation (seekingalpha.com)

For the sake of recall, Segment, which was acquired for $3.2 billion about three-and-a-half years ago, is in the red, and as a result, activist investors like Legion Partners and Anson Funds are losing interest in the business and even Twilio's complete requesting a sale. The board-level battle reached a climax, with founder and CEO Jeff Lawson resigning in January. Additionally, according to the fourth quarter earnings update, management conducted a review of its operations to identify “.The right path to improved execution and profitable growth”.

The unanimous conclusion was to maintain this segment's business while taking steps to quickly increase profitability by the fourth quarter of 2025. Also announced was the appointment of Thomas Wyatt (APPD), People.ai, who previously held leadership and analytics roles at his AppDynamics at Cisco (CSCO). The strategy is to use the segment business as a differentiator to enhance its communications product offering through the use of artificial intelligence.

Use segments as differentiators

If you take a moment to think about it, Segment was acquired to provide more personalized customer engagement across different channels. In this regard, businesses can better understand the behavior of their customers in terms of what they are buying, how they are using apps, and which websites they are browsing. Become. Therefore, by integrating all the pieces of customer information that exist on countless systems, this means that CDPs can become the basis for projects such as CRM (customer relationship management) where understanding customer data is essential. , the purpose is to provide a global view.

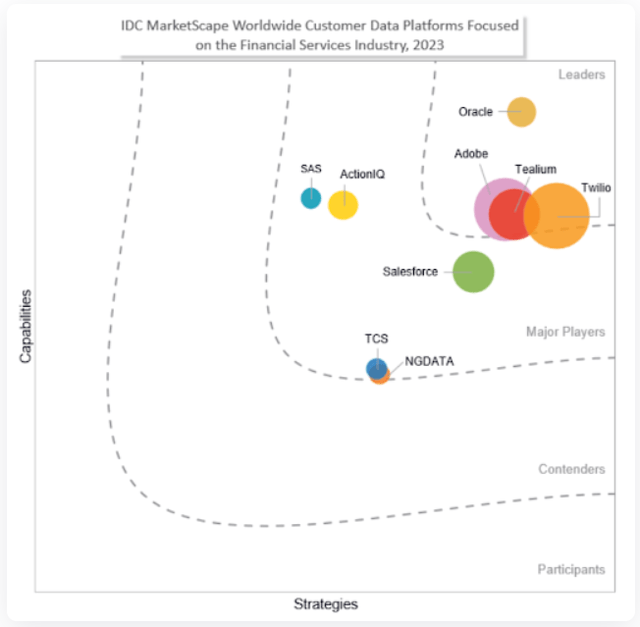

Now, if we look at the competitive positioning of the segment, we see that it ranks alongside big players like Oracle (ORCL) and Adobe (ADBE) and ahead of Salesforce (CRM) in the IDC MarketScape in 2023, as shown below. belongs to the leader category.

segment.com

That's why it recently closed an eight-figure deal and is gaining attention in the financial services industry. Other industries are also showing interest, and other large contracts (seven figures) have been signed. It may also be suitable for companies running digital experiences or marketing cloud platforms. To this end, Segment's zero-copy architecture enables customers to leverage data in their warehouses without having to transfer it to Segment's cloud, and addresses certain security and cost issues associated with data transfer. Masu.

The diagram above also shows that the major CPaaS providers mentioned above do not own a CDP, which is a strong differentiator for Twilio. Segment is a first-party CDP, and its data is collected directly from customers in the form of purchase history, information via websites, and mobile app data, not forgetting demographic-related details. In contrast to second-party or third-party CDPs, Segment collects data directly from customers rather than from secondary sources and therefore delivers greater value.

Improving cash position, timely review, share buybacks to offset risks

Therefore, given the favorable market environment and the CDP market expected to grow at a CACR of 39.9% from 2024 to 2028, a new president of the segment could quickly turn things around. To this end, additional segments and AI-related sales could boost Twilio's FY2025 revenue growth rate, which analysts expect to be 9.38%.

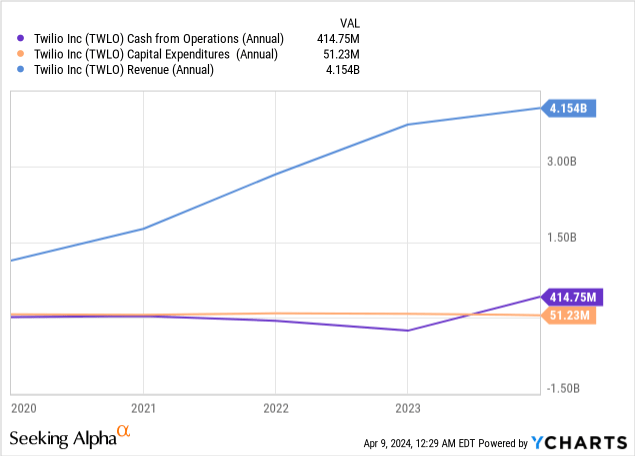

Looking further, we see that the company's forward price to cash flow is 18.43x, which makes it 18.64% cheaper than the IT sector, so we think the company deserves more valuation. Adjusting accordingly, the target price is $71 (60 x 1.1843), based on the current stock price of $60. Further supporting this bullish stance, while growing slowly by historical standards, cash generation has improved while capital expenditures have been subdued (orange chart). This shows that free cash flow remains a priority, but quarter-to-quarter fluctuations in a company with a strong balance sheet of $4 billion in cash versus $1.18 billion in debt at the end of last year is expected.

This remains a long-term goal and depends on how the situation in the segment develops. As a result, volatility could explode if there are two activist investors who currently own less than 0.5% of the stock. Twilio's Stocks expressed their impatience. Similarly, activists could increase their stake in Twilio and pressure management to make fundamental changes to the business or proceed with asset sales, putting long-term sustainability at risk. may occur.

To achieve this objective, management is conducting an operational review quickly, as the way the segment's products are bundled with communications services makes it difficult to separate the two without impacting the overall business. We avoided uncertainty by terminating. As such, the segment is strategically important to Twilio, which may partner with other ISVs (independent software vendors) looking for first-party CDP solutions to accelerate monetization. In addition, share buybacks have been increased by an additional $2 billion to benefit shareholders. The company also plans to make changes at its next annual general meeting to limit the term of its board of directors to one year.

Finally, while this stock is a buy, investors will note that in addition to AI, Twilio has positioned CDP as a key differentiator from competitors and has also looked to monetize through partnerships .