apple (NASDAQ:AAPL) The Vision Pro headset has encountered at least a little controversy, not to mention some product returns. But new reports suggest that Apple has a new direction in mind for marketing Vision Pro, and investors are very happy with the idea. I'm happy enough to give Apple a small bump in Tuesday afternoon trading.

Although there was a lot of interest in the device, many consumers were reluctant to pick up a headset that came with a $3,500 price tag. But that price is not that big of a barrier for a certain class of users: enterprise users. And it's in the enterprise market that Apple is said to be devoting much of its marketing power to growing sales. This isn't an entirely new strategy. Several Apple products started out as consumer goods, but with a little marketing, they were transformed into business-class products. For example, the iPhone started out as a consumer tool and then became a business necessity. Apple products have a wide range of use cases, so creating such a case is relatively easy.

intentionally weakened

But that's not all. As it turns out, the Vision Pro doesn't reach its full potential. According to the report, the Vision Pro app intentionally does not use the Vision Pro's camera system. Not because app developers can't figure out how to do it, but because Apple itself won't allow it. This proved to be a problem for developers who wanted to create augmented reality apps that enabled real-world interactions, but concerns about privacy and other issues led Apple to separate that part of the system. This means that some potentially very valuable use cases should remain as is. But it also means some of the biggest issues are off the table.

Is Apple a buy, hold, or sell?

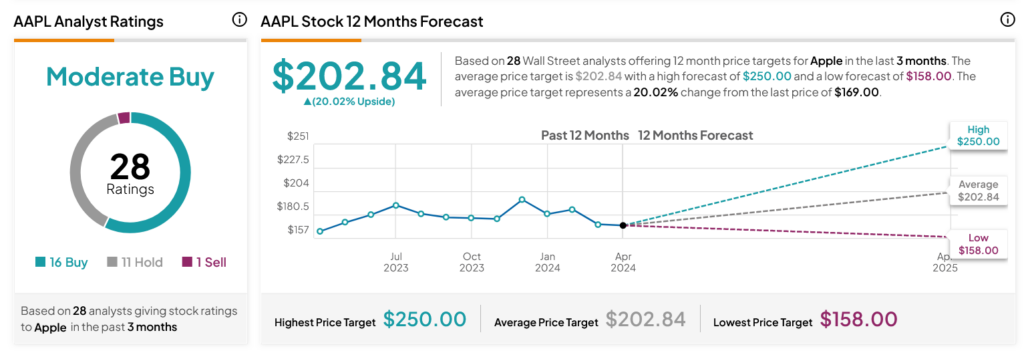

Turning to Wall Street, analysts have a consensus rating for AAPL stock based on 16 Buys, 11 Holds, and 1 Sell assignments over the past three months, as shown in the chart below. is considered a “moderate buy.” AAPL's average price target of $202.84 per share means it has upside potential of 20.02%, after the stock has gained 4.92% over the past year.

disclosure