apple (NASDAQ:AAPL), microsoft, Nvidia, Amazon, alphabet, meta platformand tesla are seven technology companies known as the “Magnificent Seven.”

Investors typically target this stock for its growth potential, but you may be wondering which Magnificent Seven stocks are the cheapest.

Based on several common valuation metrics, Apple stands out as the company with the highest overall value in the group. This is why Apple is cheaper than its top technology peers.

Apple's discounted valuation

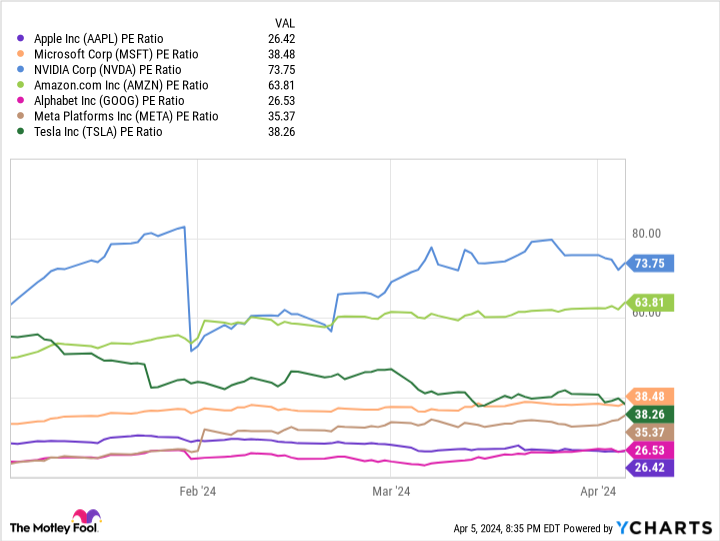

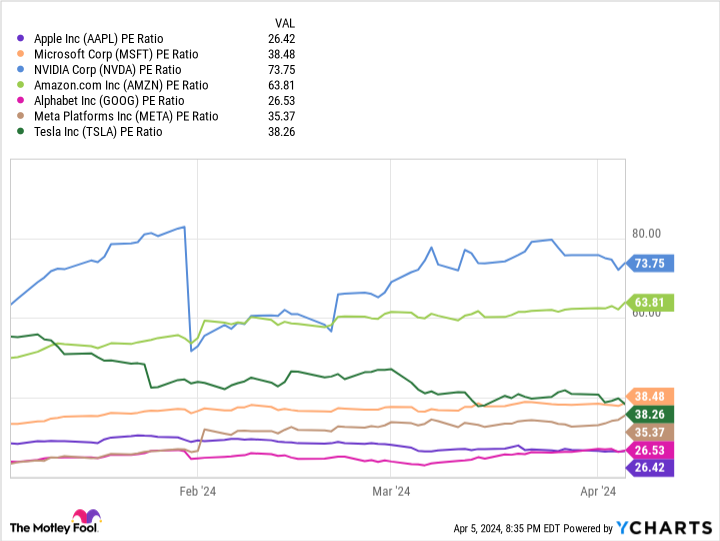

For young, non-profitable companies, the price-to-sales (P/S) ratio can be a good metric for evaluating the stock and its value relative to earnings. But for more mature, industry-leading companies, including all of the Magnificent Seven, the price-to-earnings ratio (P/E) is probably a better metric.

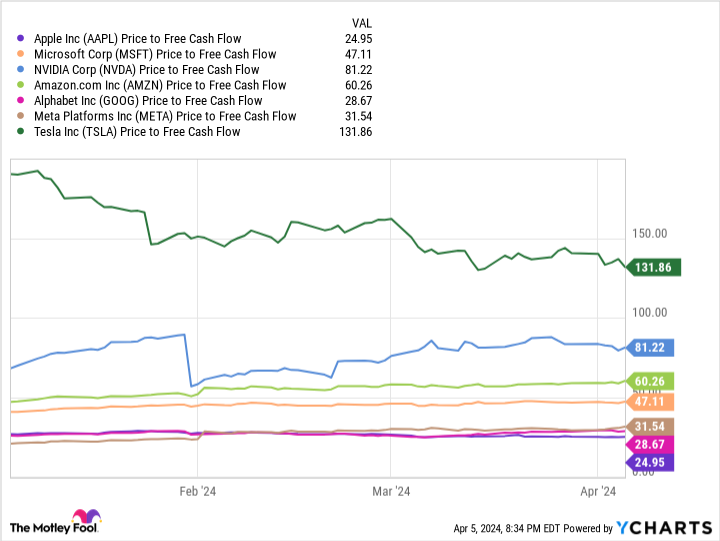

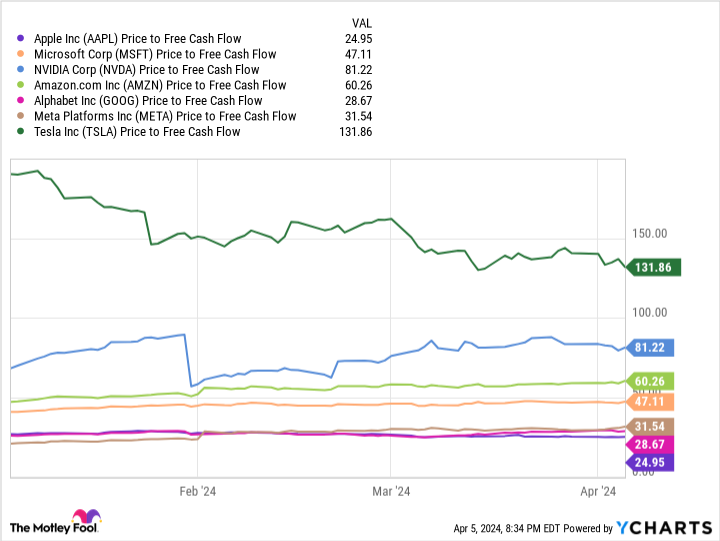

However, accounting nuances can inflate or discount a company's earnings. One-time impairment charges and gains on asset sales do not reflect the core business. With that in mind, looking at his P/E ratio in conjunction with Price to Free Cash Flow (P/FCF) can give investors a more accurate representation of a company's valuation.

Not too long ago, Alphabet was the cheapest stock in the Magnificent Seven. But the 15% rise in the stock price over the past month has boosted that valuation even further. Apple, on the other hand, fell 3% over the same period.

As a result, Apple has the lowest P/E ratio among the Magnificent Seven stocks.

It also has the lowest P/FCF multiple of 25.

Since December 2023, Apple's P/E valuation has fallen significantly, and the company is currently trading at a discount to its stock price. S&P500. But there are some good reasons for this.

Apple's problem in a nutshell

A summary of Apple's predicament: Its growth has stopped. The company is facing negative sales growth in China, and while the majority of the Magnificent Seven has monetized, it has not monetized artificial intelligence (AI) in any meaningful way. A key reason Microsoft has overtaken Apple to become the world's most valuable company is its short- and long-term plans to leverage AI across its business segments.

Apple's lack of innovation with the iPhone has been a concern for years. But perhaps more worrying is the depleted state of the new product development pipeline. Apple Vision Pro is the newest product, but it remains to be seen whether it will be as profitable as past products like the iPad, Apple Watch, and AirPods. Besides the Vision Pro, Apple hasn't released a shocking product since AirPods in September 2016.

The company is still a hugely profitable company, and its ability to buy back a lot of its own stock while raising its dividend makes its valuation more attractive even when growth is slowing. But what Apple really needs is innovation.

Investor confidence restored

Apple announced on March 26 that its annual Worldwide Developer Conference will be held from June 10 to June 14 at Apple Park in Cupertino, California.

Free for all developers, WWDC24 spotlights the latest iOS, iPadOS, macOS, watchOS, tvOS, and visionOS advances. As part of Apple's continued commitment to helping developers improve their apps and games, this event will give developers exclusive access to Apple experts and new tools. It also provides insight into the ,framework, and features.

The risk is high for two reasons. The first is that this is an opportunity for Apple to flex its technology advances with product announcements that will likely take place during its annual launch event in September. Second, the Department of Justice's lawsuit against Apple focuses on the company's relationship with developers.

Apple is in a unique position because it needs to show progress while also communicating that it's treating developers fairly.

Buy Apple for the right reasons

At a time when many tech giants are currently enjoying AI-driven valuation expansion, negative sentiment toward Apple is on the rise.

Despite these short-term pressures, Apple's core investment thesis hasn't really changed. The company remains an industry leader and perhaps the most vertically integrated company on the planet. The investment in Apple builds on the company's decades-long commitment to consumer electronics, the integration and value-add of services such as Apple TV and Apple Music, and new product development.

While the company may face some challenges in the short term, its stock shouldn't be trading at a discount to the broader market. Investors who have been paying close attention to Apple now have an opportunity to buy the company's stock at a discount. Patience will be needed, however, as it may take a while for Apple to regain support.

Should you invest $1,000 in Apple right now?

Before buying Apple stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Apple wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of April 8, 2024

Alphabet executive Suzanne Frye is a member of The Motley Fool's board of directors. Randi Zuckerberg is a former head of market development and spokesperson at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool's board of directors. John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool's board of directors. Daniel Felber has no position in any stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: A long January 2026 $395 call on Microsoft and a short January 2026 $405 call on Microsoft. The Motley Fool has a disclosure policy.

The article Cheapest Magnificent Seven Stocks Based on These Key Financial Metrics was originally published by The Motley Fool.