This was a great performance for the market, and so much so that in the first three months of this year alone, the S&P 500 hit all-time highs for 22 consecutive days.

Most people who looked at their stock portfolios this year have had the pleasant experience of seeing their holdings increase, and countless news reports and analyzes by financial experts speak optimistically about the market's strong upward momentum. ing.

But what most reports and commentary fail to point out is that inflation has risen sharply in recent years, eroding the value of stock prices along with almost everything else in the economy. When you factor in inflation, the stock market hasn't actually reached new heights.

According to calculations by Yale professor and Nobel laureate in economics Robert J. Shiller, market gains have sufficiently outpaced inflation's devastation that real stock valuations are nearing new peaks. The situation is finally changing. “On a monthly inflation-adjusted basis, the S&P 500 looks like it's right around its all-time high right now,” he said on the call.

Professor Shiller said that while the consumer price index is calculated retrospectively, stock prices are essentially instantaneous and cannot be more accurate for another month or two. He posts monthly inflation-adjusted stock, bond and earnings data on Yale's website. The S&P 500's last inflation-adjusted peak was in November 2021.

We are certainly nearing the inflation-adjusted peak, or may have already peaked, but this is a big problem. This means the market is finally starting to hit real records, driving up price-to-earnings ratios ahead of the eroding effects of inflation.

It's also a sobering reminder that despite all the good news in the stock market over the past year or so, nothing has really progressed since the second half of 2021 when you factor in inflation. Monetary illusion — a common human failure to pierce the veil imposed by inflation, which has obscured its reality.

Moreover, a rising stock market is not necessarily a good thing for true long-term investors. The recent rise in stock prices comes after long and periodic breaks in the trend of stock price increases outpacing increases in corporate earnings. This reminds Professor Schiller of the 1920s rally and the dot-com boom, both of which ended badly. If prices rise too far above earnings, liquidation will eventually be necessary. And there's a good chance that U.S. stock market returns over the next 10 years will be lower than they have been over the past 10 years, he says.

Therefore, it is essential for long-term investors to diversify their stock holdings. He uses the same investment approach recommended in this column. It's about using cheap index funds to hold the entire stock and bond market and last for decades.

good news

Inflation aside, the year has had a great start for stock investors. Most quarterly portfolio updates reflect recent gains.

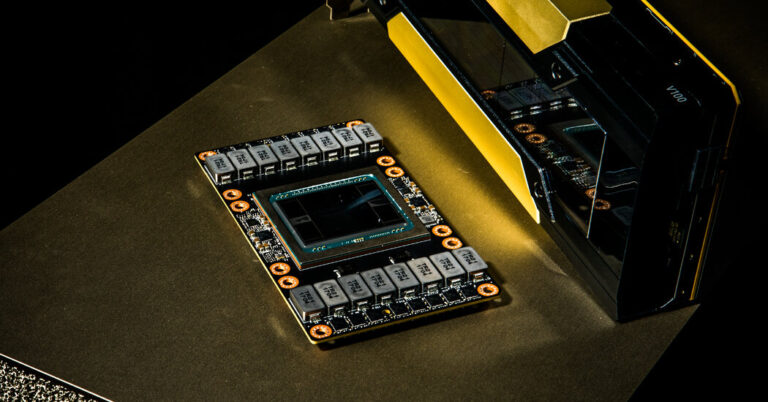

Tech stocks like chip design company Nvidia are rocketing headlong into the stratosphere, fueled by enthusiasm for artificial intelligence. But the stock market rally was also broad-based, with run-of-the-mill mutual funds and exchange-traded equity funds posting strong returns in the first quarter.

Bond funds are a different story. Interest rates rose as it became clear that the economy was strong, inflation was persistent, and that the Federal Reserve would only cut interest rates later this year, if at all. Bond prices and interest rates move in opposite directions, and bond returns for mutual funds and ETFs are a combination of yields (interest rates) and price changes. Most bond funds made gains in the first quarter, but only modestly.

Below are representative average results through March 31 for stock and bond funds, including dividends, from independent financial services firm Morningstar.

-

US stocks, 8.7% for the quarter and 24.1% for the 12 months.

-

International stocks, 4.3 percent for the quarter and 11.8 percent for the twelve months.

-

Taxable bonds: 0.7 percent quarterly, 5.6 percent over 12 months.

-

Municipal bonds, 0.4 percent quarterly, 3.9 percent over 12 months.

Among domestic funds focused on stock market sectors, technology funds stood out, with average quarterly returns of 13.6% and 42.6% over 12 months.

notable benefits

It's always possible to outperform the average by investing all your money in the best-performing stocks. For example, risk-takers who went all in on Nvidia stock rose 82.5% in the quarter and 235% in the 12 months through March.

Why stop there? Since October 19th, you can buy his ETF (T-Rex 2X Long NVIDIA Daily Target ETF), which uses leverage and derivatives with the aim of generating double returns on NVIDIA stock. The stock's performance was even better than in the first quarter, rising 205%. But if Nvidia falls for an extended period of time, and like other stocks throughout history, it will, the losses will be huge.

Nvidia generates solid and growing revenue. The fundamental question for investors is whether the company's profits can grow fast enough to justify the stock price.

Bitcoin is another matter. Its value is based solely on what people think it's worth.

Since January 11th, it has become easier for fund investors to trade cryptocurrencies. It was then that a new ETF that tracks the spot price of Bitcoin began trading. One of these funds, the iShares Bitcoin ETF, is up 52% through March. not bad!

But Bitcoin could just as easily fall and your money could evaporate. It happened in 2022 and the huge fraud behind FTX was revealed. Customers lost billions of dollars, and the cryptocurrency exchange's founder, Sam Bankman Fried, was sentenced last month to 25 years in prison. The appetite for speculation diminished in 2022, but it is clearly greedy again.

I want to triple my wealth in the past 12 months. That would have been the case if he had invested it all in Nvidia stock. Or it had increased by more than 50 percent. Bitcoin ETFs could have achieved this in just over two months. .

However, those moves seem too risky considering the money that will be needed someday. Instead, I took a long-term, multi-pronged approach, which isn't much better in the short term.

My personal returns split between stocks and bonds are the returns reported by the Vanguard Life Strategy Moderate Growth Fund, a pure index that is approximately 60% stocks and 40% bonds. It's close to. The increase was only 4.4% in the quarter. However, the return for the 12 months ending in March was 14.2%. Since its founding in 1994, the company has returned 7.4% annually. This means the value of your investment has roughly doubled every 10 years.

However, this long-term diversification approach also carries risks and should not be attempted by those who cannot or do not want to tolerate losses.

During our conversation, Professor Shiller reminded us that stock markets always recover eventually, but there is no guarantee that they will always recover. And his research shows that at current valuation levels, the U.S. market is expensive by historical standards, given the level of corporate earnings.

That doesn't necessarily mean a pressing problem. But his Nobel Prize-winning research into the price-earnings relationship showed that the S&P 500 index's potential to generate impressive returns over the next 10 years was blown out in early 2020 during the coronavirus pandemic. It suggests that the market is lower than it was when it bottomed out. -19 recession. Currently, valuations in global markets outside the US are improving and are likely to be better performing markets. These statements are probabilities and not predictions. You may not want to trade, but keep this in mind.

In some ways, he says, these times remind him of the economic boom of the 1920s. The excitement about artificial intelligence is reminiscent of the public enthusiasm for technological innovation at the time. He said it was the radio. “RCA was a big stock back then,” he says. “When I look at NVIDIA, that’s what comes to mind.”

Like the rest of the market, RCA stock crashed in 1929 (the company survived and thrived many times before becoming part of General Electric in 1985).

While there is no reliable way to predict market crashes or long-term returns, Professor Shiller says it's wise to be cautious about the money you're relying on.

This confirms the importance of owning high-quality corporate and government bonds that are likely to maintain their value even in the worst of circumstances. Diversify globally and avoid the temptation to go all-in on riskier investments, even if they have the potential for big returns in the short term.

Now that we're back to late 2021 levels, I'm sticking with this slow and relatively steady approach. I've been working there for decades. With a little luck, it still will.