(Bloomberg) — As a 20-year-old intern at a defunct German bank, Robert Stiemann's first job was operating an industrial paper cutter to cut out coupons on bonds, sometimes as long as 500 pages. Was that.

Most Read Articles on Bloomberg

It was a role that set him on the path to a career that would take him to the top of the British bond market, overseeing the biggest explosion in public sector borrowing in a generation.

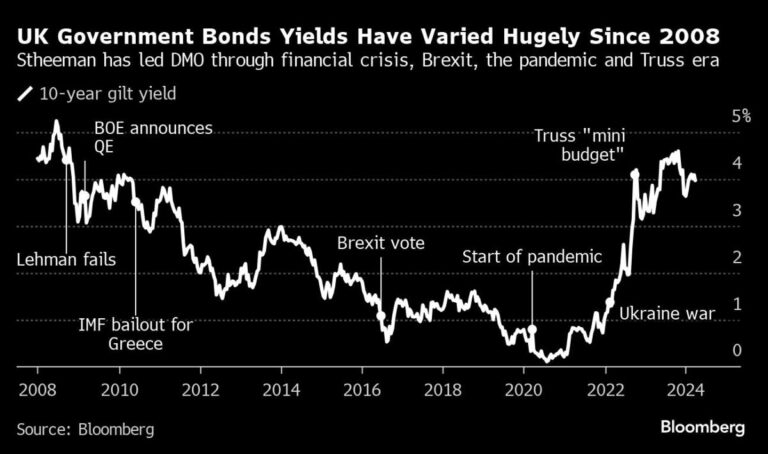

Few in the British financial industry have been as accomplished or long-serving as Mr. Steeman, who will step down after 21 years as head of the Debt Commissioner to raise more than £3 trillion ($3.8 trillion) for the country. There are very few people who continue to do so. To some London bond traders, that makes him “the most important person in town that the average person has never heard of.”

As Steeman now prepares to retire, the challenge facing his yet-to-be-announced successor is how to ensure the liquidity and stability of the market he helped create. he said.

The challenge is compounded as Britain braces for further borrowing this year, totaling around 265 billion pounds, and the central bank sells its gold holdings bought under quantitative easing. All this debt will need to find a buyer, as governments around the world issue a slew of competing issuances.

“That's why market resilience is so important,” Steeman said in an interview.

This resilience occurs in several ways. First, it's important to balance the amount of money the government needs to raise and how to make it pleasing to investors, whose preferences for long-term or short-term debt are constantly changing. It also aims to secure the loyalty of a select group of investment banks, known as gilt-edge market makers, even as hedge funds, algo traders and other types of players take up a larger portion of the market. is.

The Debt Management Office acts as an intermediary, turning the spending plans passed from the Treasury into the basis for bond sales. The department, which became independent from the Bank of England in 1998, has no say in fiscal policy and works primarily behind the scenes, choosing the maturities of the bonds it sells and ensuring that auctions run smoothly. .

Bankers who have worked with Mr. Steeman say he was calm under pressure. Deutsche Bank's Neil Ganatra said he had helped build confidence in the market, while Sam Hill of Lloyds Banking Group's LBCM division praised his “steady and predictable” approach to issuance. praised.

The role gave Mr Steeman a front row seat to the turmoil in 2022 caused by UK Chancellor Liz Truss' unfunded tax cut, which caused the biggest volatility in gold market history. He warns future politicians of the risks of ignoring the market.

“The market isn't one where you can impose your opinion and get it accepted,” Steeman said. “What policymakers and politicians ultimately need to consider is the market's view. It is pointless to disagree with that view.”

The question resonates given the country's massive debt burden and the debate over whether the massive Trump-era tax cuts, which are set to expire at the end of 2025, will be extended. Last month, Congressional Budget Office Director Philip Swagel warned in an interview with the Financial Times that if the U.S. government ignores rising levels of federal debt, the country faces the risk of a truss market shock.

Other lawmakers, such as Treasury Secretary Janet Yellen, have argued that additional borrowing is manageable given that the increase in public debt has not imposed significant interest costs, at least so far. .

The UK government also plans to ask investors to buy more bonds. DMO's 2024 funding target is the highest on record, excluding emergency loans after the 2020 pandemic.

With so many bonds to sell, Mr Steeman's successor will have to make difficult decisions to keep Britain's coffers full without overpaying. It's a lesson Steman himself learned just a few years after taking over as DMO, when the market was in turmoil following the collapse of Lehman Brothers.

Then, at the height of the financial crisis, his office rejected investors' low-budget orders for British government bond auctions on the grounds that they were of low value to taxpayers. The so-called failed bid in March 2009 triggered a slump in British debt, exacerbating the most volatile situation in British government bonds in a decade and prompting a statement from the Prime Minister defending the market's underlying strength. Asked to write a letter to the government explaining his decision, Mr Steeman said his aim was to protect British taxpayers.

This is the episode that stands as the only auction Steeman ever stumbled upon, even though all these years have passed.

“It was necessary,” he recalls. “It was a very, very intense day. But I never left the office feeling miserable at the end of the day.”

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP