Since the beginning of the year, the Pen dollar has soared 502% to a new all-time high.

This shows its significant growth amid increasing protocol activity.

What is driving Pendle's growth?

Pendle Finance, an Ethereum-based yield trading protocol, takes a unique approach to yield farming by splitting assets into principal and yield tokens. This framework allows users to trade tokens while earning yields as high as 47% from the underlying assets.

Despite being born in 2021, Pendle has seen a recent surge in hiring. This rise can be attributed to increased Ethereum liquid re-staking activity and airdrops from DeFi protocols such as Ether.Fi.

Many users are depositing eETH, the Ether.Fi restaking token, with Pendle Finance for an upcoming airdrop from AigenLayer, another restaking protocol. This is because retakers receive points from EigenLayer.

Read more: Retaking Ethereum: What is it and how does it work?

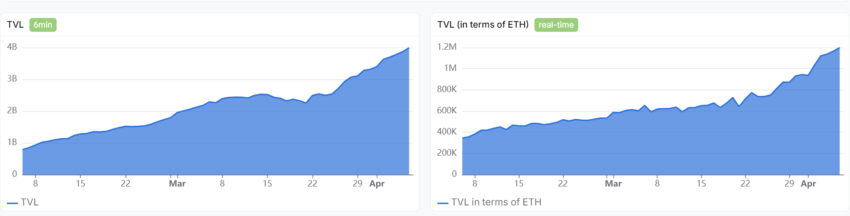

However, Pendle's recent surge in activity can be largely attributed to the company's Etena USDe pool cap being increased to 400 million. With this expansion of protocol activity, Pendle's Total Value Locked (TVL) has surpassed his $4 billion mark.

This represents an impressive increase of over 1,500% since the beginning of the year, when Pendle's TVL was at a modest $233 million. The platform's total trading volume soared to $10.5 billion. Notably, while most of this trading activity takes place on Ethereum, the project is also gaining traction on Layer 2 networks such as his Arbitrum and Mantle.

Read more: Which are the best altcoins to invest in in April 2024?

Pendle’s rapid growth has solidified its position as the largest DeFi yield protocol. Following this notable rise, BitMEX co-founder Arthur Hayes declared the platform “the future of DeFi.”

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy, and Disclaimer have been updated.